INVITE-ONLY SCRIPT

Unicorn Quant

Zaktualizowano

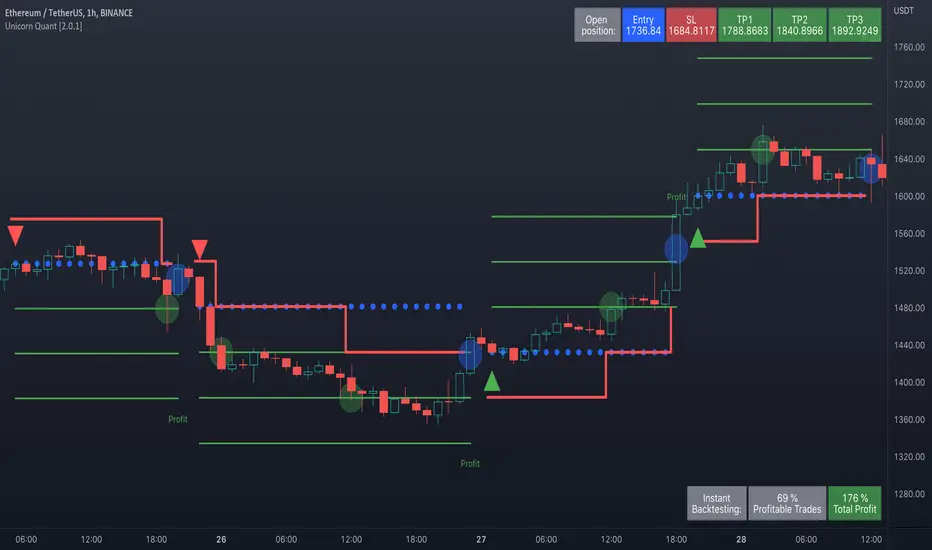

Deeply customizable trading algorithm with instant backtesting. It emulates real trading and displays all the actions it takes on the chart. For example, it shows when to enter or partially close a position, move Stop-Loss to breakeven, etc. The user can replicate these actions in their trading terminal in real time. The algorithm uses up to three Take-Profit levels, and a Stop-Loss level that can move in a trade to protect the floating profit.

The script can send real-time alerts to the user’s Email and to the cell phone via notifications in the TradingView app.

The indicator is designed to be used on all timeframes, including lower ones for intraday trading and scalping.

HOW TO USE

Set the Stop-Loss and up to three Take-Profit levels. Choose the rules for moving the Stop-Loss level in a trade. Adjust the sensitivity of the trading signals. And check the backtest result in the Instant Backtesting dashboard. If the performance of the strategy satisfies you, proceed with the forward testing or live trading.

When using this script, please, keep in mind that past results do not necessarily reflect future results and there are many factors that influence trading results.

FEATURES

Trading Signals

The feature calculates Buy and Sell signals for trend or swing trading. The user can change the Sensitivity parameter to control the frequency of the signals. This allows them to be adjusted for different markets and timeframes.

Position Manager

To make the Position Manager setup as easy as possible, the algorithm calculates Stop-Loss and Take-Profit levels in Average True Range (ATR) units. They are self-adjusting for any market and timeframe, since they account for its average volatility .

You don't have to worry about what market you are trading - Forex, Stocks, Crypto, etc. With the self-adjusting Stop-Loss and Take-Profit, you can find settings that work for one market and use the same numerical values as a starting point for a completely different market.

Instant Backtesting

After changing any settings, you can immediately see the performance of the strategy on the Instant Backtesting panel. Two metrics are displayed there - the percentage of profitable trades and the total return. This information, as well as the historical trades shown on the chart, will help you quickly and easily evaluate the settings.

SETTINGS

TRADING SIGNALS

Sensitivity - controls the sensitivity of the trading signals algorithm. It determines the frequency of the trading signals. The higher the value of this parameter, the less trading signals you get and the longer trends the algorithm tries to catch. The lower the sensitivity value, the more signals you receive. This can be useful if you want to profit from small price movements.

POSITION MANAGER

SL - sets the Stop-Loss level measured in ATR units.

TP1, TP2, TP3 - set the Take-Profit levels measured in the ATR units.

Close % at TP1, Close % at TP2, Close % at TP3 - set portions of the open position (as a percentage of the initial order size) to close at each of the TP levels.

At TP1 move SL to, At TP2 move SL to - set the rules for moving the Stop-Loss level in an open trade to protect the floating profit.

Show Open Position Dashboard - turns on/off a dashboard that shows the current Stop-Loss and Take-Profit levels for the open position.

BACKTESTING

Use Starting Date - turns on/off the starting date for the strategy and backtests. When off, all available historical data is used.

Starting Date - sets the starting date for the strategy and backtests.

Show Instant Backtesting Dashboard - turns on/off a dashboard that shows the current strategy performance: the percentage of profitable trades and total return.

Leverage - sets the leverage that the strategy uses.

The script can send real-time alerts to the user’s Email and to the cell phone via notifications in the TradingView app.

The indicator is designed to be used on all timeframes, including lower ones for intraday trading and scalping.

HOW TO USE

Set the Stop-Loss and up to three Take-Profit levels. Choose the rules for moving the Stop-Loss level in a trade. Adjust the sensitivity of the trading signals. And check the backtest result in the Instant Backtesting dashboard. If the performance of the strategy satisfies you, proceed with the forward testing or live trading.

When using this script, please, keep in mind that past results do not necessarily reflect future results and there are many factors that influence trading results.

FEATURES

Trading Signals

The feature calculates Buy and Sell signals for trend or swing trading. The user can change the Sensitivity parameter to control the frequency of the signals. This allows them to be adjusted for different markets and timeframes.

Position Manager

To make the Position Manager setup as easy as possible, the algorithm calculates Stop-Loss and Take-Profit levels in Average True Range (ATR) units. They are self-adjusting for any market and timeframe, since they account for its average volatility .

You don't have to worry about what market you are trading - Forex, Stocks, Crypto, etc. With the self-adjusting Stop-Loss and Take-Profit, you can find settings that work for one market and use the same numerical values as a starting point for a completely different market.

Instant Backtesting

After changing any settings, you can immediately see the performance of the strategy on the Instant Backtesting panel. Two metrics are displayed there - the percentage of profitable trades and the total return. This information, as well as the historical trades shown on the chart, will help you quickly and easily evaluate the settings.

SETTINGS

TRADING SIGNALS

Sensitivity - controls the sensitivity of the trading signals algorithm. It determines the frequency of the trading signals. The higher the value of this parameter, the less trading signals you get and the longer trends the algorithm tries to catch. The lower the sensitivity value, the more signals you receive. This can be useful if you want to profit from small price movements.

POSITION MANAGER

SL - sets the Stop-Loss level measured in ATR units.

TP1, TP2, TP3 - set the Take-Profit levels measured in the ATR units.

Close % at TP1, Close % at TP2, Close % at TP3 - set portions of the open position (as a percentage of the initial order size) to close at each of the TP levels.

At TP1 move SL to, At TP2 move SL to - set the rules for moving the Stop-Loss level in an open trade to protect the floating profit.

Show Open Position Dashboard - turns on/off a dashboard that shows the current Stop-Loss and Take-Profit levels for the open position.

BACKTESTING

Use Starting Date - turns on/off the starting date for the strategy and backtests. When off, all available historical data is used.

Starting Date - sets the starting date for the strategy and backtests.

Show Instant Backtesting Dashboard - turns on/off a dashboard that shows the current strategy performance: the percentage of profitable trades and total return.

Leverage - sets the leverage that the strategy uses.

Informacje o Wersji

Version 2.0.2. Trading alerts feature update. The trading alerts feature in version 2.0.2 has been updated and extended to support third-party services that receive TradingView alerts via webhooks, including AutoView, Alertatron, Aleeert, 3Commas, WunderTrading, and others. This new functionality enables you to use the indicator as a trading bot, executing trades on various exchanges based on the signals generated by the indicator, or to post your alerts to trading groups and channels.Skrypt tylko na zaproszenie

Dostęp do tego skryptu mają tylko użytkownicy upoważnieni przez autora i zazwyczaj wiąże się z opłatą. Możesz dodać go do ulubionych, ale będziesz mógł z niego korzystać dopiero po uzyskaniu zgody jego autora. Skontaktuj się z AstrideUnicorn po więcej informacji lub postępuj zgodnie z instrukcjami autora poniżej.

TradingView nie sugeruje płacenia za skrypt i korzystania z niego, jeśli nie ufasz w 100% jego autorowi i nie rozumiesz, jak działa skrypt. W wielu przypadkach możesz znaleźć dobrą alternatywę open-source za darmo w naszych Skryptach Społeczności.

Instrukcje autora

″Get access here: https://unicorn.trading

Chcesz użyć tego skryptu na wykresie?

Ostrzeżenie: przeczytaj to zanim poprosisz o dostęp.

Our premium trading indicators: unicorn.trading

Join our Discord community: dsc.gg/unicom

Join our Discord community: dsc.gg/unicom

Wyłączenie odpowiedzialności

Informacje i publikacje przygotowane przez TradingView lub jego użytkowników, prezentowane na tej stronie, nie stanowią rekomendacji ani porad handlowych, inwestycyjnych i finansowych i nie powinny być w ten sposób traktowane ani wykorzystywane. Więcej informacji na ten temat znajdziesz w naszym Regulaminie.