OPEN-SOURCE SCRIPT

Bitmex Funding Killzones v3 [MaliciousUpload]

Originally built off of "Oscarvs: BITCOIN KILL ZONES v2" indicator, updated to now highlight a different time period based event.

1. The indicator should not be affected by what time zone you are in, it will show true Funding periods by default.

2. This needs to be used on the 1min time frame to be used to its full extent

3. The more the funding fee is the more likely you are to have price get manipulated by people looking to act on its benefit

4. This indicator will work only for XBTUSD and ETHUSD perpetual contract symbols as they are the only two ones with funding...

My opinion: Funding is literally the exchanges insurance policy, they are "the house", they will always win.

With that in mind you can trade "with the house" in this regard, getting onto the side that will benefit from exponentially large funding rebates.

Do you ever ask how those "whales" got to be rich? It was by saving every penny they could while trading.

Funding gives people the option to jump out right before, avoiding the fee and then immediately enter in after at no loss (assuming limit orders ofc).

If that doesn't make sense to you i cant help, sorry. :pray: :pray: :pray:

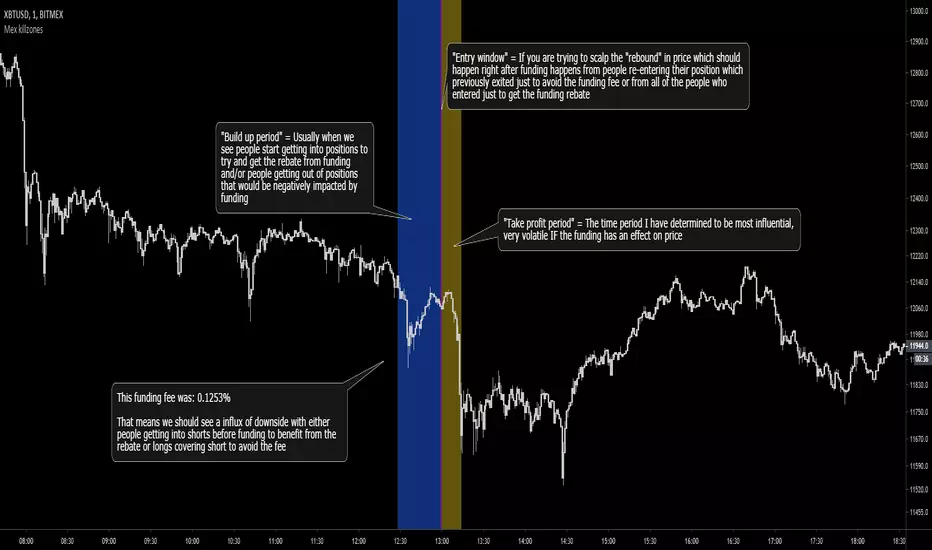

"Build up period" = Usually when we see people start getting into positions to try and get the rebate from funding and/or people getting out of positions that would be negatively impacted by funding

"Entry window" = If you are trying to scalp the "rebound" in price which should happen right after funding happens from people re-entering their position which previously exited just to avoid the funding fee or from all of the people who entered just to get the funding rebate

"Take profit period" = The time period I have determined to be most influential, very volatile IF the funding has an effect on price

Hit me up on Discord if you are an **experienced** trader that takes trading seriously.

MaliciousUpload#1637

1. The indicator should not be affected by what time zone you are in, it will show true Funding periods by default.

2. This needs to be used on the 1min time frame to be used to its full extent

3. The more the funding fee is the more likely you are to have price get manipulated by people looking to act on its benefit

4. This indicator will work only for XBTUSD and ETHUSD perpetual contract symbols as they are the only two ones with funding...

My opinion: Funding is literally the exchanges insurance policy, they are "the house", they will always win.

With that in mind you can trade "with the house" in this regard, getting onto the side that will benefit from exponentially large funding rebates.

Do you ever ask how those "whales" got to be rich? It was by saving every penny they could while trading.

Funding gives people the option to jump out right before, avoiding the fee and then immediately enter in after at no loss (assuming limit orders ofc).

If that doesn't make sense to you i cant help, sorry. :pray: :pray: :pray:

"Build up period" = Usually when we see people start getting into positions to try and get the rebate from funding and/or people getting out of positions that would be negatively impacted by funding

"Entry window" = If you are trying to scalp the "rebound" in price which should happen right after funding happens from people re-entering their position which previously exited just to avoid the funding fee or from all of the people who entered just to get the funding rebate

"Take profit period" = The time period I have determined to be most influential, very volatile IF the funding has an effect on price

Hit me up on Discord if you are an **experienced** trader that takes trading seriously.

MaliciousUpload#1637

Skrypt open-source

W zgodzie z duchem TradingView twórca tego skryptu udostępnił go jako open-source, aby użytkownicy mogli przejrzeć i zweryfikować jego działanie. Ukłony dla autora. Korzystanie jest bezpłatne, jednak ponowna publikacja kodu podlega naszym Zasadom serwisu.

Wyłączenie odpowiedzialności

Informacje i publikacje nie stanowią i nie powinny być traktowane jako porady finansowe, inwestycyjne, tradingowe ani jakiekolwiek inne rekomendacje dostarczane lub zatwierdzone przez TradingView. Więcej informacji znajduje się w Warunkach użytkowania.

Skrypt open-source

W zgodzie z duchem TradingView twórca tego skryptu udostępnił go jako open-source, aby użytkownicy mogli przejrzeć i zweryfikować jego działanie. Ukłony dla autora. Korzystanie jest bezpłatne, jednak ponowna publikacja kodu podlega naszym Zasadom serwisu.

Wyłączenie odpowiedzialności

Informacje i publikacje nie stanowią i nie powinny być traktowane jako porady finansowe, inwestycyjne, tradingowe ani jakiekolwiek inne rekomendacje dostarczane lub zatwierdzone przez TradingView. Więcej informacji znajduje się w Warunkach użytkowania.