OPEN-SOURCE SCRIPT

Zaktualizowano Bollinger Bands Filter

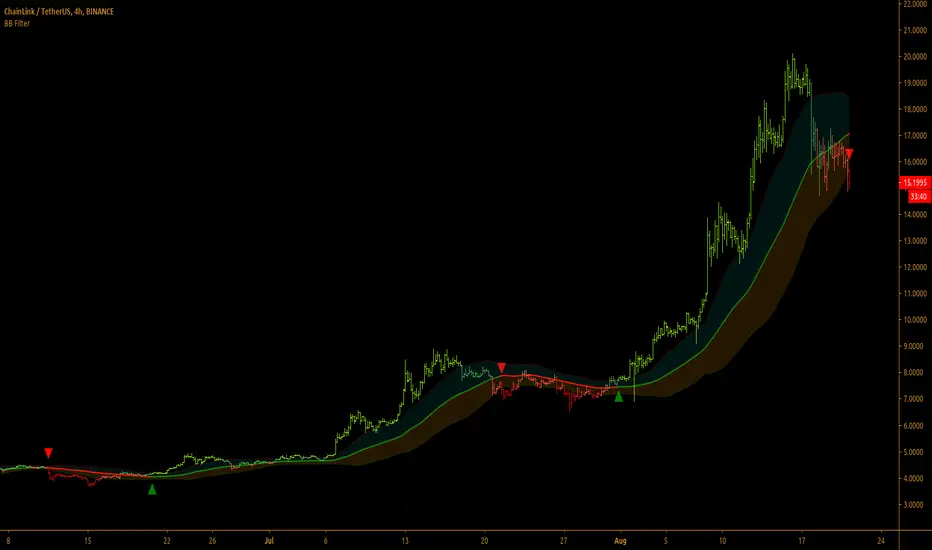

Bollinger Bands is a classic indicator that uses a simple moving average of 20 periods, along with plots of upper and lower bands that are 2 standard deviations away from the basis line. These bands help visualize price volatility and trend based on where the price is, in relation to the bands.

Bollinger Bands filter plots a long signal when price closes above the upper band and plots a short signal when price closes below the lower band. It doesn't take into account any other parameters such as Volume/RSI/ Fundamentals etc, so user must use discretion based on confirmations from another indicator or based on fundamentals.

The filter works great when the price closes above/below upper/lower bands with continuation on next bar. It is definitely useful to have this filter along with other indicators to get early glimpse of breach/fail of bands on candle close during BB squeeze or based on volatility.

This can be used on Heikin Ashi candles for spotting trends, but HA candles are not recommended for trade entries as they don't reflect true price of the asset.

This filter's default is 55 SMA and 1 standard deviation, but these can be changed from settings.

It is definitely worth reading the 22 rules of Bollinger Bands written by John Bollinger.

==================================================================

Note:

1. Alerts can be created for long and short signals using "Once per bar close".

2. The indicator doesn't repaint.

==================================================================

Informacje o Wersji

Code updatedInformacje o Wersji

Standard Deviation - Float values can be used (2.0 max). For example, for lower lookback length, standard deviation of 1.5, 1.618 etc. can be used to get stable trade entries. Similarly, for longer lookback, 0.236, 0.618, 0.886 etc. values can be used.Skrypt open-source

W zgodzie z duchem TradingView twórca tego skryptu udostępnił go jako open-source, aby użytkownicy mogli przejrzeć i zweryfikować jego działanie. Ukłony dla autora. Korzystanie jest bezpłatne, jednak ponowna publikacja kodu podlega naszym Zasadom serwisu.

Get in touch with me if you would like access to my Premium scripts for a trial before deciding on lifetime access.

Telegram - @Trade_Chartist

Free Scripts - bit.ly/Free-Scripts

Telegram - @Trade_Chartist

Free Scripts - bit.ly/Free-Scripts

Wyłączenie odpowiedzialności

Informacje i publikacje nie stanowią i nie powinny być traktowane jako porady finansowe, inwestycyjne, tradingowe ani jakiekolwiek inne rekomendacje dostarczane lub zatwierdzone przez TradingView. Więcej informacji znajduje się w Warunkach użytkowania.

Skrypt open-source

W zgodzie z duchem TradingView twórca tego skryptu udostępnił go jako open-source, aby użytkownicy mogli przejrzeć i zweryfikować jego działanie. Ukłony dla autora. Korzystanie jest bezpłatne, jednak ponowna publikacja kodu podlega naszym Zasadom serwisu.

Get in touch with me if you would like access to my Premium scripts for a trial before deciding on lifetime access.

Telegram - @Trade_Chartist

Free Scripts - bit.ly/Free-Scripts

Telegram - @Trade_Chartist

Free Scripts - bit.ly/Free-Scripts

Wyłączenie odpowiedzialności

Informacje i publikacje nie stanowią i nie powinny być traktowane jako porady finansowe, inwestycyjne, tradingowe ani jakiekolwiek inne rekomendacje dostarczane lub zatwierdzone przez TradingView. Więcej informacji znajduje się w Warunkach użytkowania.