breakout-strategy

Wskaźniki, strategie i biblioteki

This is a strategy intended primarily for algorithmic traders. It's a pseudo-grid bot that uses a dynamic, volume-weighted grid that only updates when the RSI meets certain conditions. It's also a breakout strategy, whereas normal grid bots are not (typical grid bots sell when a higher grid is reached, whereas this strategy sells when a lower grid is breached...

The Bollinger Bands - Breakout Strategy is a trend-following optimized for short-term trading in the crypto market. This strategy employs the Bollinger Bands, a widely recognized technical indicator, as its primary instrument for pinpointing potential trades. It is capable of executing both long and short positions, depending on whether the market is in a spot or...

Description: A Long only strategy based on breakout from a certain level formed by High price. It has auto-backtesting capabilities (you set ranges for the three main parameters: Lookback, TP and SL; the strategy then goes through different combinations of those parameters and displays a table with results that you can sort by Percentage of profitable trades...

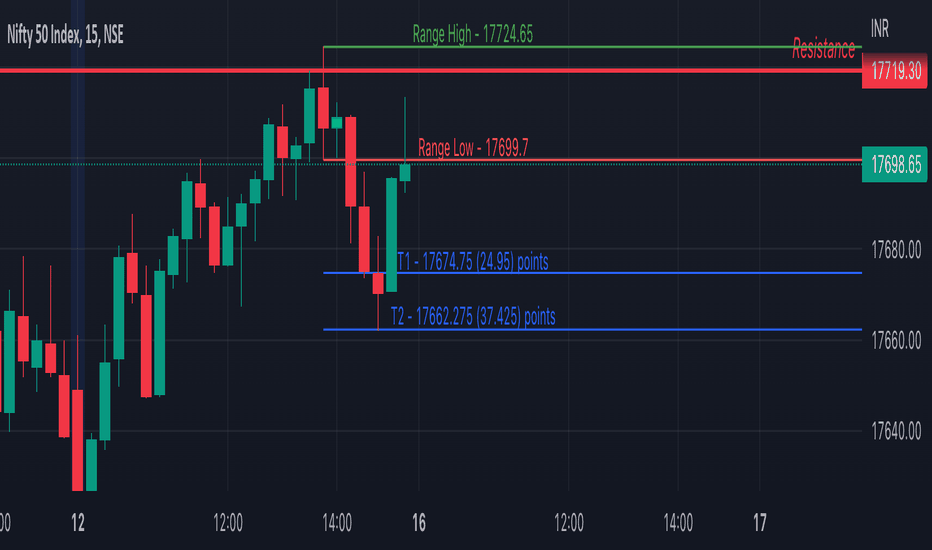

Script Details - This script plots Inside Bar for given day in selected time-frame (applicable only for Timeframes < Day) - Basis plotted inside bar, relevant targets are marked on the chart - Targets can be customised from script settings. Example, if range of mother candle is 10 points, then T1 is 10 * x above/below mother candle and T2 is 10 * y above/below...

This is a strategy used by Larry R. Williams called Volatility Breakout. By identifying a strong uptrend that exceeds 'a certain level' on a daily basis as a breakout signal, enter long position, take advantage of long at the the next day's open. 'a certain level (Entry Price)' is calculated by { close + 'k' * high -low }, and applied logarithmic...

This is a follow up to my previous publication of Adaptive HMA+ few months ago, as a mean to provide some kind of initial backtesting tools. Which can be use to explore many possible strategies, optimise its settings to better conform user's pair/tf, and hopefully able to help tweaking your general strategy. If you haven't read the study or use the indicator,...

Anti-Breakout Strategy Description: This is a contrarian entry strategy for trading false breakouts. The high/low of the breakout bar is used for the entry in the opposite direction. To reduce repainting set ptype variable to OHL3.

Fractal A type of pattern used in technical analysis to predict a reversal in the current trend. A fractal pattern consists of five bars and is identified when the price meets the following characteristics: 1. A shift from a downtrend to an uptrend occurs when the lowest bar is located in the middle of the pattern and two bars with successively higher lows are...

Previous Day High and Low Breakout Strategy

This long only strategy determines the price of the last fractal top and enters a trade when the price breaks above the last fractal top. The strategy also calculates the average price of the last fractal tops to get the trend direction. The strategy exits the long trade, when the average of the fractal tops is falling (when the trend is lower highs as measured by...

Exits added using trailing stops. 2.6 Profit Factor and 76% Profitable on SPY , 5M - I think it's a pretty good number for an automated strategy that uses Pivots. I don't think it's possible to add volume and day open price in relation to pivot levels -- that's what I do manually .. Still trying to add EMA for exits.. it will increase profitability. You can...

![[-_-] Level Breakout, Auto Backtesting Strategy ETHUSDT: [-_-] Level Breakout, Auto Backtesting Strategy](https://s3.tradingview.com/a/AlYtV1Lo_mid.png)