OPEN-SOURCE SCRIPT

Pro Bollinger Bands Calculator

The "Pro Bollinger Bands Calculator" indicator joins our suite of custom trading tools, which includes the "Pro Supertrend Calculator", the "Pro RSI Calculator" and the "Pro Momentum Calculator."

Expanding on this series, the "Pro Bollinger Bands Calculator" is tailored to offer traders deeper insights into market dynamics by harnessing the power of the Bollinger Bands indicator.

Its core mission remains unchanged: to scrutinize historical price data and provide informed predictions about future price movements, with a specific focus on detecting potential bullish (green) or bearish (red) candlestick patterns.

1. Bollinger Bands Calculation:

The indicator kicks off by computing the Bollinger Bands, a well-known volatility indicator. It calculates two pivotal Bollinger Bands parameters:

- Bollinger Bands Length: This parameter sets the lookback period for Bollinger Bands calculations.

- Bollinger Bands Deviation: It determines the deviation multiplier for the upper and lower bands, typically set at 2.0.

2. Visualizing Bollinger Bands:

The Bollinger Bands derived from the calculations are skillfully plotted on the price chart:

- Red Line: Represents the upper Bollinger Band during bearish trends, suggesting potential price declines.

- Teal Line: Represents the lower Bollinger Band in bullish market conditions, signaling the possibility of price increases.

3.Analyzing Consecutive Candlesticks:

The indicator's core functionality revolves around tracking consecutive candlestick patterns based on their relationship with the Bollinger Bands lines. To be considered for analysis, a candlestick must consistently close either above (green candles) or below (red candles) the Bollinger Bands lines for multiple consecutive periods.

4. Labeling and Enumeration:

To convey the count of consecutive candles displaying consistent trend behavior, the indicator meticulously assigns labels to the price chart. The position of these labels varies depending on the direction of the trend, appearing either below (for bullish patterns) or above (for bearish patterns) the candlesticks. The label colors match the candle colors: green labels for bullish candles and red labels for bearish ones.

5. Tabular Data Presentation:

The indicator complements its graphical analysis with a customizable table that prominently displays comprehensive statistical insights. Key data points within the table encompass:

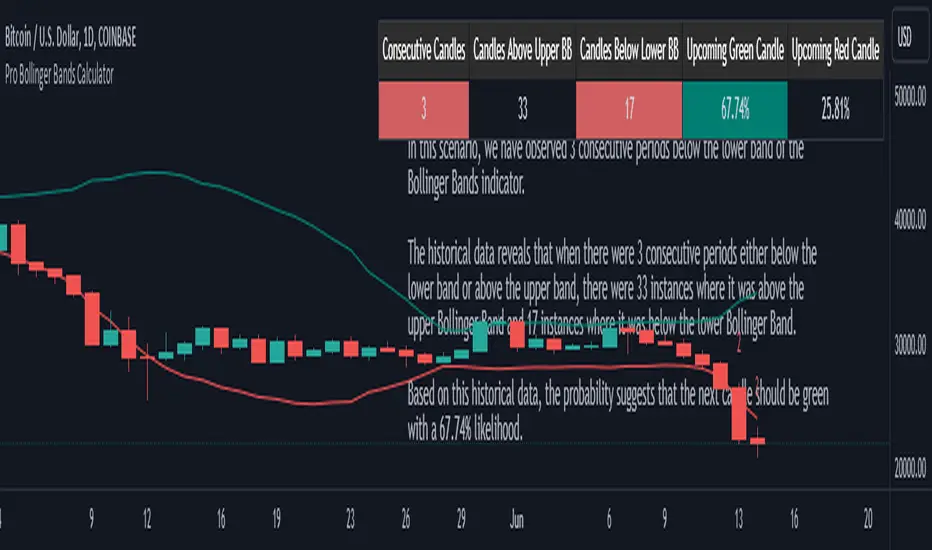

- Consecutive Candles: The count of consecutive candles displaying consistent trend characteristics.

- Candles Above Upper BB: The number of candles closing above the upper Bollinger Band during the consecutive period.

- Candles Below Lower BB: The number of candles closing below the lower Bollinger Band during the consecutive period.

- Upcoming Green Candle: An estimated probability of the next candlestick being bullish, derived from historical data.

- Upcoming Red Candle: An estimated probability of the next candlestick being bearish, also based on historical data.

6. Custom Configuration:

To cater to diverse trading strategies and preferences, the indicator offers extensive customization options. Traders can fine-tune parameters such as Bollinger Bands length, upper and lower band deviations, label and table placement, and table size to align with their unique trading approaches.

Expanding on this series, the "Pro Bollinger Bands Calculator" is tailored to offer traders deeper insights into market dynamics by harnessing the power of the Bollinger Bands indicator.

Its core mission remains unchanged: to scrutinize historical price data and provide informed predictions about future price movements, with a specific focus on detecting potential bullish (green) or bearish (red) candlestick patterns.

1. Bollinger Bands Calculation:

The indicator kicks off by computing the Bollinger Bands, a well-known volatility indicator. It calculates two pivotal Bollinger Bands parameters:

- Bollinger Bands Length: This parameter sets the lookback period for Bollinger Bands calculations.

- Bollinger Bands Deviation: It determines the deviation multiplier for the upper and lower bands, typically set at 2.0.

2. Visualizing Bollinger Bands:

The Bollinger Bands derived from the calculations are skillfully plotted on the price chart:

- Red Line: Represents the upper Bollinger Band during bearish trends, suggesting potential price declines.

- Teal Line: Represents the lower Bollinger Band in bullish market conditions, signaling the possibility of price increases.

3.Analyzing Consecutive Candlesticks:

The indicator's core functionality revolves around tracking consecutive candlestick patterns based on their relationship with the Bollinger Bands lines. To be considered for analysis, a candlestick must consistently close either above (green candles) or below (red candles) the Bollinger Bands lines for multiple consecutive periods.

4. Labeling and Enumeration:

To convey the count of consecutive candles displaying consistent trend behavior, the indicator meticulously assigns labels to the price chart. The position of these labels varies depending on the direction of the trend, appearing either below (for bullish patterns) or above (for bearish patterns) the candlesticks. The label colors match the candle colors: green labels for bullish candles and red labels for bearish ones.

5. Tabular Data Presentation:

The indicator complements its graphical analysis with a customizable table that prominently displays comprehensive statistical insights. Key data points within the table encompass:

- Consecutive Candles: The count of consecutive candles displaying consistent trend characteristics.

- Candles Above Upper BB: The number of candles closing above the upper Bollinger Band during the consecutive period.

- Candles Below Lower BB: The number of candles closing below the lower Bollinger Band during the consecutive period.

- Upcoming Green Candle: An estimated probability of the next candlestick being bullish, derived from historical data.

- Upcoming Red Candle: An estimated probability of the next candlestick being bearish, also based on historical data.

6. Custom Configuration:

To cater to diverse trading strategies and preferences, the indicator offers extensive customization options. Traders can fine-tune parameters such as Bollinger Bands length, upper and lower band deviations, label and table placement, and table size to align with their unique trading approaches.

Skrypt open-source

W zgodzie z duchem TradingView twórca tego skryptu udostępnił go jako open-source, aby użytkownicy mogli przejrzeć i zweryfikować jego działanie. Ukłony dla autora. Korzystanie jest bezpłatne, jednak ponowna publikacja kodu podlega naszym Zasadom serwisu.

Plan the trade ⚡ Trade the plan

Wyłączenie odpowiedzialności

Informacje i publikacje nie stanowią i nie powinny być traktowane jako porady finansowe, inwestycyjne, tradingowe ani jakiekolwiek inne rekomendacje dostarczane lub zatwierdzone przez TradingView. Więcej informacji znajduje się w Warunkach użytkowania.

Skrypt open-source

W zgodzie z duchem TradingView twórca tego skryptu udostępnił go jako open-source, aby użytkownicy mogli przejrzeć i zweryfikować jego działanie. Ukłony dla autora. Korzystanie jest bezpłatne, jednak ponowna publikacja kodu podlega naszym Zasadom serwisu.

Plan the trade ⚡ Trade the plan

Wyłączenie odpowiedzialności

Informacje i publikacje nie stanowią i nie powinny być traktowane jako porady finansowe, inwestycyjne, tradingowe ani jakiekolwiek inne rekomendacje dostarczane lub zatwierdzone przez TradingView. Więcej informacji znajduje się w Warunkach użytkowania.