OPEN-SOURCE SCRIPT

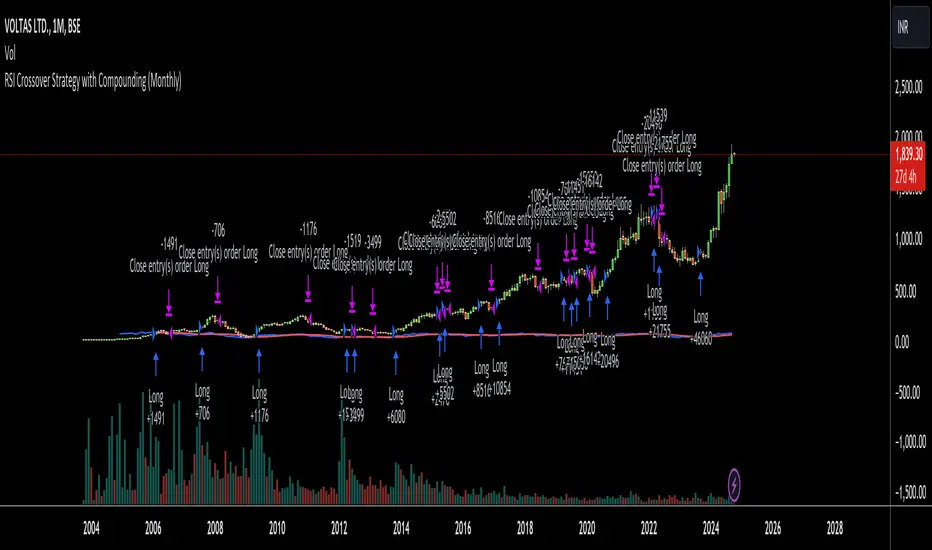

RSI Crossover Strategy with Compounding (Monthly)

Explanation of the Code:

Initial Setup:

The strategy initializes with a capital of 100,000.

Variables track the capital and the amount invested in the current trade.

RSI Calculation:

The RSI and its SMA are calculated on the monthly timeframe using request.security().

Entry and Exit Conditions:

Entry: A long position is initiated when the RSI is above its SMA and there’s no existing position. The quantity is based on available capital.

Exit: The position is closed when the RSI falls below its SMA. The capital is updated based on the net profit from the trade.

Capital Management:

After closing a trade, the capital is updated with the net profit plus the initial investment.

Plotting:

The RSI and its SMA are plotted for visualization on the chart.

A label displays the current capital.

Notes:

Test the strategy on different instruments and historical data to see how it performs.

Adjust parameters as needed for your specific trading preferences.

This script is a basic framework, and you might want to enhance it with risk management, stop-loss, or take-profit features as per your trading strategy.

Feel free to modify it further based on your needs!

Initial Setup:

The strategy initializes with a capital of 100,000.

Variables track the capital and the amount invested in the current trade.

RSI Calculation:

The RSI and its SMA are calculated on the monthly timeframe using request.security().

Entry and Exit Conditions:

Entry: A long position is initiated when the RSI is above its SMA and there’s no existing position. The quantity is based on available capital.

Exit: The position is closed when the RSI falls below its SMA. The capital is updated based on the net profit from the trade.

Capital Management:

After closing a trade, the capital is updated with the net profit plus the initial investment.

Plotting:

The RSI and its SMA are plotted for visualization on the chart.

A label displays the current capital.

Notes:

Test the strategy on different instruments and historical data to see how it performs.

Adjust parameters as needed for your specific trading preferences.

This script is a basic framework, and you might want to enhance it with risk management, stop-loss, or take-profit features as per your trading strategy.

Feel free to modify it further based on your needs!

Skrypt open-source

W zgodzie z duchem TradingView twórca tego skryptu udostępnił go jako open-source, aby użytkownicy mogli przejrzeć i zweryfikować jego działanie. Ukłony dla autora. Korzystanie jest bezpłatne, jednak ponowna publikacja kodu podlega naszym Zasadom serwisu.

Wyłączenie odpowiedzialności

Informacje i publikacje nie stanowią i nie powinny być traktowane jako porady finansowe, inwestycyjne, tradingowe ani jakiekolwiek inne rekomendacje dostarczane lub zatwierdzone przez TradingView. Więcej informacji znajduje się w Warunkach użytkowania.

Skrypt open-source

W zgodzie z duchem TradingView twórca tego skryptu udostępnił go jako open-source, aby użytkownicy mogli przejrzeć i zweryfikować jego działanie. Ukłony dla autora. Korzystanie jest bezpłatne, jednak ponowna publikacja kodu podlega naszym Zasadom serwisu.

Wyłączenie odpowiedzialności

Informacje i publikacje nie stanowią i nie powinny być traktowane jako porady finansowe, inwestycyjne, tradingowe ani jakiekolwiek inne rekomendacje dostarczane lub zatwierdzone przez TradingView. Więcej informacji znajduje się w Warunkach użytkowania.