OPEN-SOURCE SCRIPT

COIN/BTC Trend Oscillator

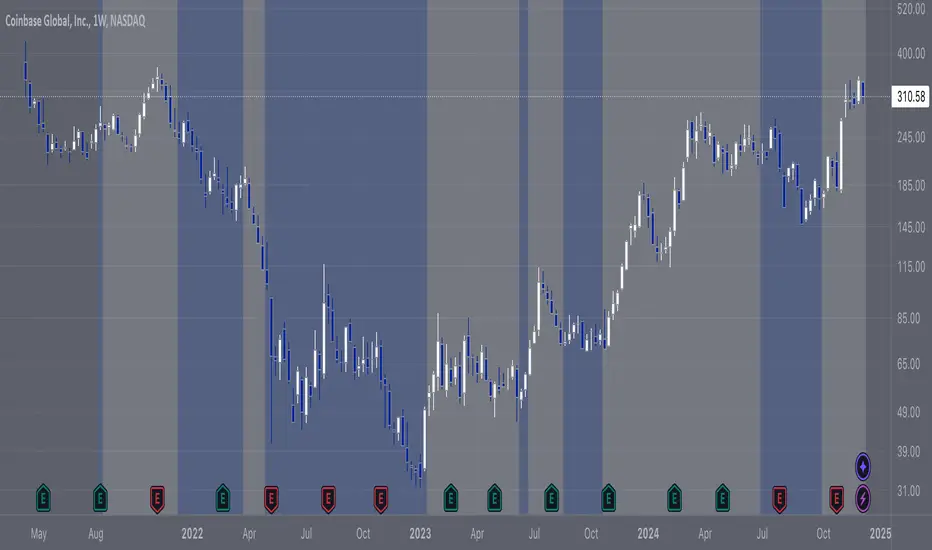

The COIN/BTC Trend Oscillator is a versatile tool designed to measure and visualize momentum divergences between Coinbase stock ( COIN) and Bitcoin (

COIN) and Bitcoin ( BTC). It helps identify overbought and oversold conditions, while also highlighting potential trend reversals.

BTC). It helps identify overbought and oversold conditions, while also highlighting potential trend reversals.

Key Features:

Use Case:

This indicator is ideal for trading Coinbase stock relative to Bitcoin’s momentum. It’s especially useful during strong market trends, helping traders time entries and exits based on extremes in relative performance.

Limitations:

• Performance may degrade in choppy or sideways markets.

• Assumes a strong correlation between COIN and

COIN and  BTC, which may not hold during independent events.

BTC, which may not hold during independent events.

Pro Tip: Use this oscillator with broader trend confirmation tools like moving averages or RSI to improve reliability. For macro strategies, consider combining with higher timeframes for alignment.

Key Features:

- VWAP-Based Divergence Analysis:

• Tracks the difference betweenCOIN and

BTC relative to their respective VWAPs.

• Highlights shifts in momentum between the two assets. - Normalized Oscillator:

• Uses ATR normalization to adapt to different volatility conditions.

• Displays momentum shifts on a standardized scale for better comparability. - Overbought and Oversold Conditions:

• Identifies extremes using customizable thresholds (default: ±80).

• Dynamic background colors for quick visual identification:

• Blue for overbought zones (potential sell).

• White for oversold zones (potential buy). - Rolling Highs and Lows Detection:

• Tracks turning points in the oscillator to identify possible trend reversals.

• Useful for spotting exhaustion or accumulation phases.

Use Case:

This indicator is ideal for trading Coinbase stock relative to Bitcoin’s momentum. It’s especially useful during strong market trends, helping traders time entries and exits based on extremes in relative performance.

Limitations:

• Performance may degrade in choppy or sideways markets.

• Assumes a strong correlation between

Pro Tip: Use this oscillator with broader trend confirmation tools like moving averages or RSI to improve reliability. For macro strategies, consider combining with higher timeframes for alignment.

Skrypt open-source

W zgodzie z duchem TradingView twórca tego skryptu udostępnił go jako open-source, aby użytkownicy mogli przejrzeć i zweryfikować jego działanie. Ukłony dla autora. Korzystanie jest bezpłatne, jednak ponowna publikacja kodu podlega naszym Zasadom serwisu.

Wyłączenie odpowiedzialności

Informacje i publikacje nie stanowią i nie powinny być traktowane jako porady finansowe, inwestycyjne, tradingowe ani jakiekolwiek inne rekomendacje dostarczane lub zatwierdzone przez TradingView. Więcej informacji znajduje się w Warunkach użytkowania.

Skrypt open-source

W zgodzie z duchem TradingView twórca tego skryptu udostępnił go jako open-source, aby użytkownicy mogli przejrzeć i zweryfikować jego działanie. Ukłony dla autora. Korzystanie jest bezpłatne, jednak ponowna publikacja kodu podlega naszym Zasadom serwisu.

Wyłączenie odpowiedzialności

Informacje i publikacje nie stanowią i nie powinny być traktowane jako porady finansowe, inwestycyjne, tradingowe ani jakiekolwiek inne rekomendacje dostarczane lub zatwierdzone przez TradingView. Więcej informacji znajduje się w Warunkach użytkowania.