OPEN-SOURCE SCRIPT

Day-Type Detector — Rejection / FNL / Outside / StopRun (Clean)

Day-Type Detector — Rejection / FNL / Outside / Stop-Run (Clean Version)

This indicator identifies four high-impact candlestick day-types commonly used in professional price-action and auction-market trading: Rejection Days, Failed New Low (FNL) Days, Outside Days, and Stop-Run Days. These patterns often precede major directional moves, reversals, and absorption events, making them particularly valuable for swing traders, positional traders, and short-term discretionary traders.

The script is designed to work across all timeframes and is built around volatility-adjusted measurements using Average Daily Range (ADR) for accuracy and consistency.

What This Indicator Detects

1. Rejection Day (Bullish & Bearish)

A Rejection Day is a wide-range bar that rejects a previous extreme.

The indicator identifies rejection based on:

Range > ADR × threshold

Long lower wick (for bullish) or long upper wick (for bearish)

Close located in the strong zone of the day’s range

These conditions highlight areas where aggressive counter-orderflow entered the market.

2. Failed New Low (FNL) / Failed New High

An FNL day traps traders who attempted breakout selling or buying.

The indicator checks for:

A break beyond the previous session’s low or high

Immediate rejection back inside

Midpoint recapture conditions

ADR-normalized range requirements

These days often trigger powerful directional reversals.

3. Outside Day (Bullish & Bearish)

An Outside Day is a statistically significant expansion day that breaks both the previous high and low.

The script validates:

High > previous high and low < previous low

Range > ADR threshold

Close beyond prior session extreme to complete the rejection sequence

Outside Days often represent stop runs, shakeouts, or trend accelerations.

4. Stop-Run Day (Bullish & Bearish)

Stop-Run Days are aggressive volatility expansions and tend to be the largest ranges within short windows.

This detector identifies them using:

Range > ADR × multiplier

Close located near the extreme of the day (top for bullish, bottom for bearish)

Strong body relative to total range

Break above/below previous session extreme

These patterns indicate capitulation or forced liquidation and are often followed by continuation or sharp counter-rotation.

Key Features

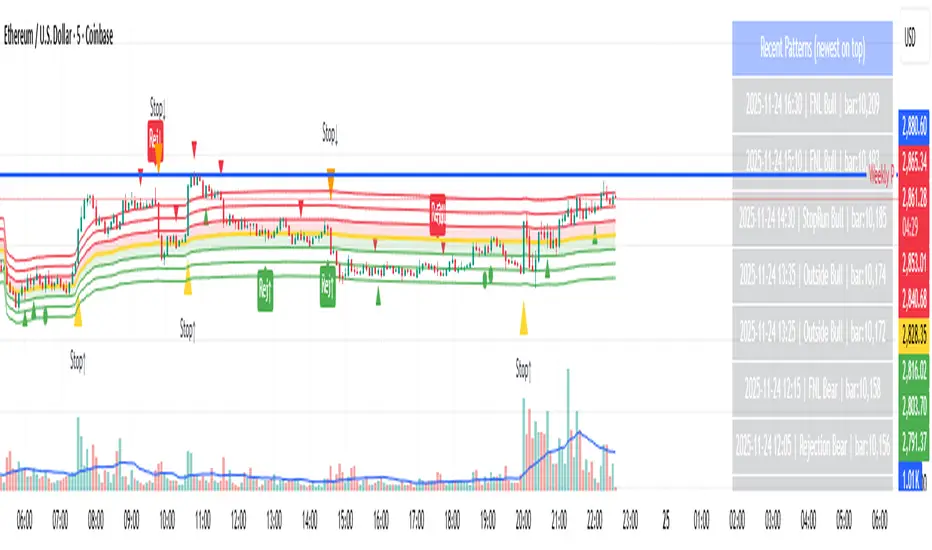

✔ Historical Pattern Marking

All qualifying bars are marked on the chart using plotshape() in global scope, ensuring full historical visibility.

✔ Event Logging & Table Display

A table (top-right of the chart) displays the most recent pattern detections, including:

Timestamp

Pattern type

Bar index

This allows users to monitor and study past pattern occurrences without scanning the chart manually.

✔ ADR-Adjusted Detection

Volatility uncertainty is removed by anchoring all thresholds to ADR.

This ensures consistency across:

Different symbols

Different timeframes

Different market regimes

✔ Alerts Included

Alerts are preconfigured for:

Rejection Day Bull / Bear

FNL Bull / Bear

Outside Day Bull / Bear

Stop-Run Bull / Bear

This allows the user to receive real-time notifications when major day-type structures develop.

How to Use

Add the indicator to any timeframe chart.

Enable or disable:

Historical markers

History table

ADR diagnostics

Watch for shape markers or use alerts for real-time signals.

Use the history table to review recent occurrences.

Combine these day-types with:

Market structure levels

High/low volume nodes (LVNs)

Support/resistance zones

Trend context

These day-types are most effective when they occur near meaningful structural levels because they show where strong order-flow entered the market.

Best Practices

Use higher timeframes (1H–1D) for swing entries.

Confirm signals with market structure or volume profile.

Treat these day-types as context, not standalone signals.

Observe follow-through behavior in the next 1–3 bars after detection.

Credits

This script is based on concepts commonly seen in auction-market theory and professional price-action frameworks, such as Rejection Days, Failed New Lows, Outside Days, and Stop-Run behaviors.

All calculations and logic have been rebuilt from scratch to ensure clean, reliable, and optimized Pine Script v6 execution.

This indicator identifies four high-impact candlestick day-types commonly used in professional price-action and auction-market trading: Rejection Days, Failed New Low (FNL) Days, Outside Days, and Stop-Run Days. These patterns often precede major directional moves, reversals, and absorption events, making them particularly valuable for swing traders, positional traders, and short-term discretionary traders.

The script is designed to work across all timeframes and is built around volatility-adjusted measurements using Average Daily Range (ADR) for accuracy and consistency.

What This Indicator Detects

1. Rejection Day (Bullish & Bearish)

A Rejection Day is a wide-range bar that rejects a previous extreme.

The indicator identifies rejection based on:

Range > ADR × threshold

Long lower wick (for bullish) or long upper wick (for bearish)

Close located in the strong zone of the day’s range

These conditions highlight areas where aggressive counter-orderflow entered the market.

2. Failed New Low (FNL) / Failed New High

An FNL day traps traders who attempted breakout selling or buying.

The indicator checks for:

A break beyond the previous session’s low or high

Immediate rejection back inside

Midpoint recapture conditions

ADR-normalized range requirements

These days often trigger powerful directional reversals.

3. Outside Day (Bullish & Bearish)

An Outside Day is a statistically significant expansion day that breaks both the previous high and low.

The script validates:

High > previous high and low < previous low

Range > ADR threshold

Close beyond prior session extreme to complete the rejection sequence

Outside Days often represent stop runs, shakeouts, or trend accelerations.

4. Stop-Run Day (Bullish & Bearish)

Stop-Run Days are aggressive volatility expansions and tend to be the largest ranges within short windows.

This detector identifies them using:

Range > ADR × multiplier

Close located near the extreme of the day (top for bullish, bottom for bearish)

Strong body relative to total range

Break above/below previous session extreme

These patterns indicate capitulation or forced liquidation and are often followed by continuation or sharp counter-rotation.

Key Features

✔ Historical Pattern Marking

All qualifying bars are marked on the chart using plotshape() in global scope, ensuring full historical visibility.

✔ Event Logging & Table Display

A table (top-right of the chart) displays the most recent pattern detections, including:

Timestamp

Pattern type

Bar index

This allows users to monitor and study past pattern occurrences without scanning the chart manually.

✔ ADR-Adjusted Detection

Volatility uncertainty is removed by anchoring all thresholds to ADR.

This ensures consistency across:

Different symbols

Different timeframes

Different market regimes

✔ Alerts Included

Alerts are preconfigured for:

Rejection Day Bull / Bear

FNL Bull / Bear

Outside Day Bull / Bear

Stop-Run Bull / Bear

This allows the user to receive real-time notifications when major day-type structures develop.

How to Use

Add the indicator to any timeframe chart.

Enable or disable:

Historical markers

History table

ADR diagnostics

Watch for shape markers or use alerts for real-time signals.

Use the history table to review recent occurrences.

Combine these day-types with:

Market structure levels

High/low volume nodes (LVNs)

Support/resistance zones

Trend context

These day-types are most effective when they occur near meaningful structural levels because they show where strong order-flow entered the market.

Best Practices

Use higher timeframes (1H–1D) for swing entries.

Confirm signals with market structure or volume profile.

Treat these day-types as context, not standalone signals.

Observe follow-through behavior in the next 1–3 bars after detection.

Credits

This script is based on concepts commonly seen in auction-market theory and professional price-action frameworks, such as Rejection Days, Failed New Lows, Outside Days, and Stop-Run behaviors.

All calculations and logic have been rebuilt from scratch to ensure clean, reliable, and optimized Pine Script v6 execution.

Skrypt open-source

W zgodzie z duchem TradingView twórca tego skryptu udostępnił go jako open-source, aby użytkownicy mogli przejrzeć i zweryfikować jego działanie. Ukłony dla autora. Korzystanie jest bezpłatne, jednak ponowna publikacja kodu podlega naszym Zasadom serwisu.

Wyłączenie odpowiedzialności

Informacje i publikacje nie stanowią i nie powinny być traktowane jako porady finansowe, inwestycyjne, tradingowe ani jakiekolwiek inne rekomendacje dostarczane lub zatwierdzone przez TradingView. Więcej informacji znajduje się w Warunkach użytkowania.

Skrypt open-source

W zgodzie z duchem TradingView twórca tego skryptu udostępnił go jako open-source, aby użytkownicy mogli przejrzeć i zweryfikować jego działanie. Ukłony dla autora. Korzystanie jest bezpłatne, jednak ponowna publikacja kodu podlega naszym Zasadom serwisu.

Wyłączenie odpowiedzialności

Informacje i publikacje nie stanowią i nie powinny być traktowane jako porady finansowe, inwestycyjne, tradingowe ani jakiekolwiek inne rekomendacje dostarczane lub zatwierdzone przez TradingView. Więcej informacji znajduje się w Warunkach użytkowania.