OPEN-SOURCE SCRIPT

Zaktualizowano HeatCandle

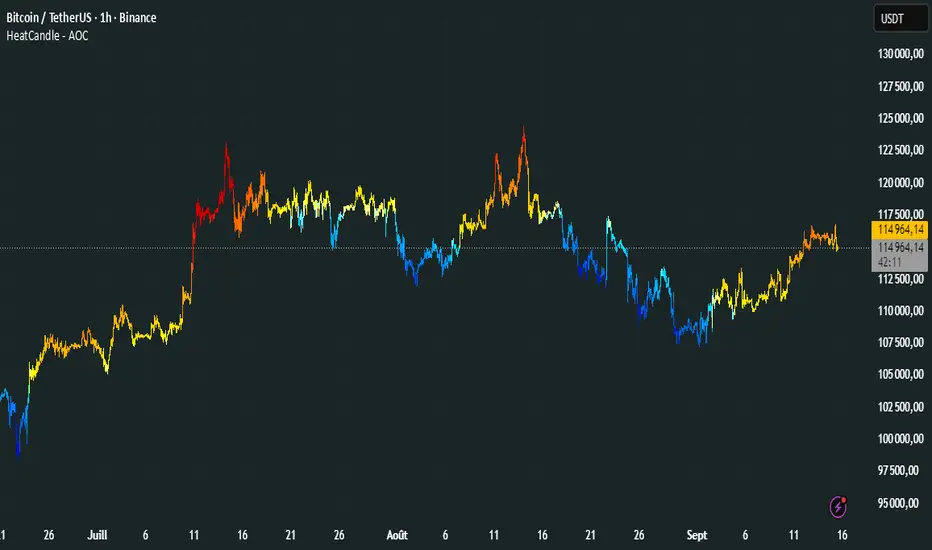

HeatCandle - AOC Indicator

✨ Features

📊 Heat-Map Candles: Colors candles based on the price’s deviation from a Triangular Moving Average (TMA), creating a heat-map effect to visualize price zones.

📏 Zone-Based Coloring: Assigns colors to 20 distinct zones (Z0 to Z19) based on the percentage distance from the TMA, with customizable thresholds.

⚙️ Timeframe-Specific Zones: Tailored zone thresholds for 1-minute, 5-minute, 15-minute, 30-minute, 1-hour, and 4-hour timeframes for precise analysis.

🎨 Customizable Visuals: Gradient color scheme from deep blue (oversold) to red (overbought) for intuitive price movement interpretation.

🛠️ Adjustable Parameters: Configure TMA length and threshold multiplier to fine-tune sensitivity.

🛠️ How to Use

Add to Chart: Apply the "HeatCandle - AOC" indicator on TradingView.

Configure Inputs:

TMA Length: Set the period for the Triangular Moving Average (default: 150).

Threshold Multiplier: Adjust the multiplier to scale zone sensitivity (default: 1.0).

Analyze: Observe colored candles on the chart, where colors indicate the price’s deviation from the TMA:

Dark blue (Z0) indicates strong oversold conditions.

Red (Z19) signals strong overbought conditions.

Track Trends: Use the color zones to identify potential reversals, breakouts, or trend strength based on price distance from the TMA.

🎯 Why Use It?

Visual Clarity: The heat-map candle coloring simplifies identifying overbought/oversold conditions at a glance.

Timeframe Flexibility: Zone thresholds adapt to the selected timeframe, ensuring relevance across short and long-term trading.

Customizable Sensitivity: Adjust TMA length and multiplier to match your trading style or market conditions.

Versatile Analysis: Ideal for scalping, swing trading, or trend analysis when combined with other indicators.

📝 Notes

Ensure sufficient historical data for accurate TMA calculations, especially with longer lengths.

The indicator is most effective on volatile markets where price deviations are significant.

Pair with momentum indicators (e.g., RSI, MACD) or support/resistance levels for enhanced trading strategies.

Happy trading! 🚀📈

✨ Features

📊 Heat-Map Candles: Colors candles based on the price’s deviation from a Triangular Moving Average (TMA), creating a heat-map effect to visualize price zones.

📏 Zone-Based Coloring: Assigns colors to 20 distinct zones (Z0 to Z19) based on the percentage distance from the TMA, with customizable thresholds.

⚙️ Timeframe-Specific Zones: Tailored zone thresholds for 1-minute, 5-minute, 15-minute, 30-minute, 1-hour, and 4-hour timeframes for precise analysis.

🎨 Customizable Visuals: Gradient color scheme from deep blue (oversold) to red (overbought) for intuitive price movement interpretation.

🛠️ Adjustable Parameters: Configure TMA length and threshold multiplier to fine-tune sensitivity.

🛠️ How to Use

Add to Chart: Apply the "HeatCandle - AOC" indicator on TradingView.

Configure Inputs:

TMA Length: Set the period for the Triangular Moving Average (default: 150).

Threshold Multiplier: Adjust the multiplier to scale zone sensitivity (default: 1.0).

Analyze: Observe colored candles on the chart, where colors indicate the price’s deviation from the TMA:

Dark blue (Z0) indicates strong oversold conditions.

Red (Z19) signals strong overbought conditions.

Track Trends: Use the color zones to identify potential reversals, breakouts, or trend strength based on price distance from the TMA.

🎯 Why Use It?

Visual Clarity: The heat-map candle coloring simplifies identifying overbought/oversold conditions at a glance.

Timeframe Flexibility: Zone thresholds adapt to the selected timeframe, ensuring relevance across short and long-term trading.

Customizable Sensitivity: Adjust TMA length and multiplier to match your trading style or market conditions.

Versatile Analysis: Ideal for scalping, swing trading, or trend analysis when combined with other indicators.

📝 Notes

Ensure sufficient historical data for accurate TMA calculations, especially with longer lengths.

The indicator is most effective on volatile markets where price deviations are significant.

Pair with momentum indicators (e.g., RSI, MACD) or support/resistance levels for enhanced trading strategies.

Happy trading! 🚀📈

Informacje o Wersji

V2Skrypt open-source

W zgodzie z duchem TradingView twórca tego skryptu udostępnił go jako open-source, aby użytkownicy mogli przejrzeć i zweryfikować jego działanie. Ukłony dla autora. Korzystanie jest bezpłatne, jednak ponowna publikacja kodu podlega naszym Zasadom serwisu.

My Website for the traders !

Wyłączenie odpowiedzialności

Informacje i publikacje nie stanowią i nie powinny być traktowane jako porady finansowe, inwestycyjne, tradingowe ani jakiekolwiek inne rekomendacje dostarczane lub zatwierdzone przez TradingView. Więcej informacji znajduje się w Warunkach użytkowania.

Skrypt open-source

W zgodzie z duchem TradingView twórca tego skryptu udostępnił go jako open-source, aby użytkownicy mogli przejrzeć i zweryfikować jego działanie. Ukłony dla autora. Korzystanie jest bezpłatne, jednak ponowna publikacja kodu podlega naszym Zasadom serwisu.

My Website for the traders !

Wyłączenie odpowiedzialności

Informacje i publikacje nie stanowią i nie powinny być traktowane jako porady finansowe, inwestycyjne, tradingowe ani jakiekolwiek inne rekomendacje dostarczane lub zatwierdzone przez TradingView. Więcej informacji znajduje się w Warunkach użytkowania.