PROTECTED SOURCE SCRIPT

Zaktualizowano Pro Volume Lite

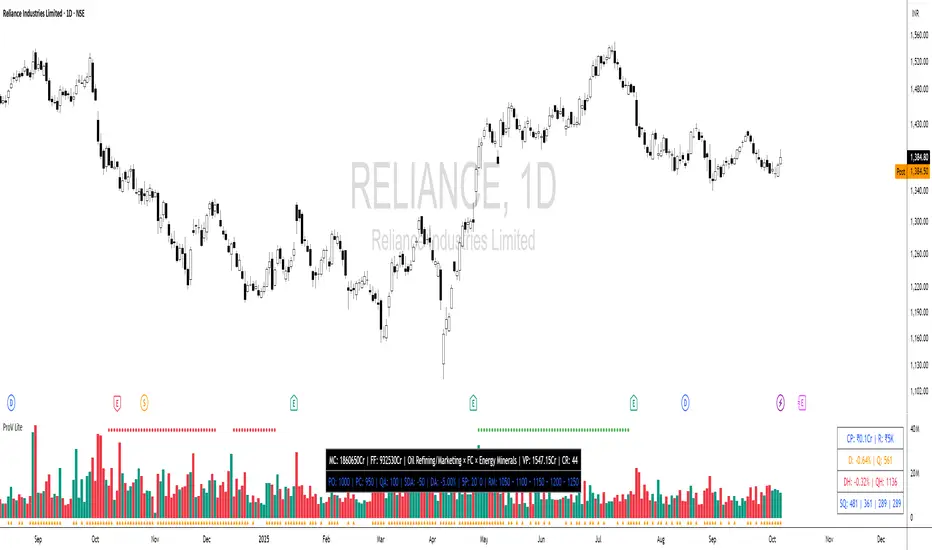

📘 Pro Volume Lite

What it is:

Pro Volume Lite is a tool that helps you quickly figure out:

How much quantity to buy or sell,

Where your risk stands,

How volume and trend strength are behaving,

Plus some quick company fundamentals.

🔹 1. Position Size & Risk Management

✅ Settings

Trade Direction:

Long → Bullish trades only.

Short → Bearish trades only.

Both → Auto-switch depending on whether today’s price change is up or down.

Capital (CP):

Enter your account size (example: 10,00,000).

This is the base for position size calculations.

Risk Mode (R):

Currency → Risk a fixed amount per trade (e.g., $5000).

Percentage → Risk a fixed % of your capital (e.g., 0.5%).

⚡ The script automatically calculates how much money you’re risking per trade based on your choice.

✅ Stop & Quantity Calculations

D (Stop Low %) → How far today’s close is from the day’s low.

DH (Stop High %) → How far close is from the mid-body of today’s candle.

Q (Quantity) → How many shares you can buy/sell if stop = day’s low.

QH (Quantity High) → Quantity if stop = mid-body.

SSL #1, #2, #3 → Standard stop-loss setups (e.g., 0.75%, 1%, 1.25%).

💡 If you enable Lot Size, all quantities are converted into nearest lot multiples (good for futures).

🔹 2. Volume Bar Coloring

Green = Price closed higher than it opened.

Red = Price closed lower than it opened.

Plots on the volume chart so you can see bullish/bearish volume.

🔹 3. Trend Intensity (TI)

Uses two moving averages (fast & slow).

Green dot on top → Trend strongly bullish.

Red dot on top → Trend strongly bearish.

Helps you spot momentum shifts.

🔹 4. Episodic Pivot (EP)

Marks big volume spikes with orange triangles under candles.

Default threshold = 9 million volume.

Shows when institutions may be entering/exiting.

🔹 5. Data Metrics Table

Quick fundamentals shown in a table:

MC (Market Cap): Company’s total market value.

Industry × Sector: Classification for the stock.

FF (Free Float): Value of shares available for public trading.

💡 In INR stocks → values are shown in Crores.

💡 In USD stocks → values shown in raw currency format.

⚡ Bottom Line

Pro Volume Lite helps you:

Size your trades correctly,

Control your risk,

Spot strong volume moves,

Check quick fundamentals,

All inside your TradingView chart.

What it is:

Pro Volume Lite is a tool that helps you quickly figure out:

How much quantity to buy or sell,

Where your risk stands,

How volume and trend strength are behaving,

Plus some quick company fundamentals.

🔹 1. Position Size & Risk Management

✅ Settings

Trade Direction:

Long → Bullish trades only.

Short → Bearish trades only.

Both → Auto-switch depending on whether today’s price change is up or down.

Capital (CP):

Enter your account size (example: 10,00,000).

This is the base for position size calculations.

Risk Mode (R):

Currency → Risk a fixed amount per trade (e.g., $5000).

Percentage → Risk a fixed % of your capital (e.g., 0.5%).

⚡ The script automatically calculates how much money you’re risking per trade based on your choice.

✅ Stop & Quantity Calculations

D (Stop Low %) → How far today’s close is from the day’s low.

DH (Stop High %) → How far close is from the mid-body of today’s candle.

Q (Quantity) → How many shares you can buy/sell if stop = day’s low.

QH (Quantity High) → Quantity if stop = mid-body.

SSL #1, #2, #3 → Standard stop-loss setups (e.g., 0.75%, 1%, 1.25%).

💡 If you enable Lot Size, all quantities are converted into nearest lot multiples (good for futures).

🔹 2. Volume Bar Coloring

Green = Price closed higher than it opened.

Red = Price closed lower than it opened.

Plots on the volume chart so you can see bullish/bearish volume.

🔹 3. Trend Intensity (TI)

Uses two moving averages (fast & slow).

Green dot on top → Trend strongly bullish.

Red dot on top → Trend strongly bearish.

Helps you spot momentum shifts.

🔹 4. Episodic Pivot (EP)

Marks big volume spikes with orange triangles under candles.

Default threshold = 9 million volume.

Shows when institutions may be entering/exiting.

🔹 5. Data Metrics Table

Quick fundamentals shown in a table:

MC (Market Cap): Company’s total market value.

Industry × Sector: Classification for the stock.

FF (Free Float): Value of shares available for public trading.

💡 In INR stocks → values are shown in Crores.

💡 In USD stocks → values shown in raw currency format.

⚡ Bottom Line

Pro Volume Lite helps you:

Size your trades correctly,

Control your risk,

Spot strong volume moves,

Check quick fundamentals,

All inside your TradingView chart.

Informacje o Wersji

Here are the new features added to the updated script, in bullet points:* **Manual Trade Input**: You can now manually enter your **Entry Price** and **Actual Quantity** after you've taken a trade.

* **Precise Stop-Loss Calculation**: Based on your manual entry, the script calculates the **exact stop-loss price** you need to use to stay within your planned risk.

* **"Parts Selling" Calculator**: A new tool helps you scale out of winning trades by showing you how to sell your position in equal, smaller parts.

* **R-Multiple Profit Targets**: The script now automatically calculates and displays multiple price targets based on your initial risk (e.g., where to take profits for a 1R, 2R, 3R gain).

* **"Volume × Price" (Turnover)**: A new metric was added to the data table, showing the total dollar value traded for the current bar.

* **Dedicated Trade Management Row**: A new row was added to the main data table to display all of the above information (your live trade entry, stop-loss, and profit targets) in one convenient place.

Informacje o Wersji

Rearrangement of table cells.Informacje o Wersji

Rearranged the table cells.Informacje o Wersji

$DA & Parts Things removed.Added CR to the indicator.

Informacje o Wersji

Added SQ#4.Remove Default Bar option.

Informacje o Wersji

Added $DA.Informacje o Wersji

Added Parts things with sell into strength.Secondary table orientation also is different.

Optimized for speed.

Informacje o Wersji

Added F&O Status.Moved from manual Lot sizing to auto lot sizing.

Informacje o Wersji

Minor Fix.Informacje o Wersji

Minor Bug Fix. Informacje o Wersji

Changed Default Color Settings.Skrypt chroniony

Ten skrypt został opublikowany jako zamknięty kod źródłowy. Możesz jednak używać go swobodnie i bez żadnych ograniczeń – więcej informacji tutaj.

Wyłączenie odpowiedzialności

Informacje i publikacje przygotowane przez TradingView lub jego użytkowników, prezentowane na tej stronie, nie stanowią rekomendacji ani porad handlowych, inwestycyjnych i finansowych i nie powinny być w ten sposób traktowane ani wykorzystywane. Więcej informacji na ten temat znajdziesz w naszym Regulaminie.

Skrypt chroniony

Ten skrypt został opublikowany jako zamknięty kod źródłowy. Możesz jednak używać go swobodnie i bez żadnych ograniczeń – więcej informacji tutaj.

Wyłączenie odpowiedzialności

Informacje i publikacje przygotowane przez TradingView lub jego użytkowników, prezentowane na tej stronie, nie stanowią rekomendacji ani porad handlowych, inwestycyjnych i finansowych i nie powinny być w ten sposób traktowane ani wykorzystywane. Więcej informacji na ten temat znajdziesz w naszym Regulaminie.