OPEN-SOURCE SCRIPT

Targets For Overlay Indicators [LuxAlgo]

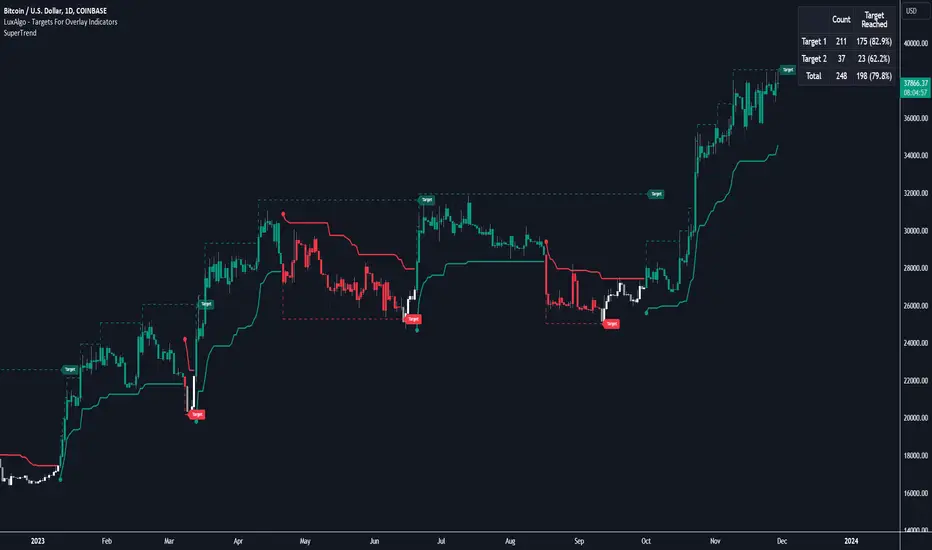

The Targets For Overlay Indicators is a useful utility tool able to display targets during crossings made between the price and external indicators on the user chart. Users can display a series of two targets, one for crossover events and another one for crossunder event.

Alerts are included for the occurrence of a new target as well as for reached targets.

🔶 USAGE

In order for targets to be displayed users need to select an appropriate input source from the "Source" drop-down input setting. In the example above we apply the indicator to a volatility stop.

This can also easily be done by adding the "Targets For Overlay Indicators" script on the VStop indicator directly.

Targets can help users determine the price limit where the price might start deviating from an indication given by one or multiple indicators. In the context of trading, targets can help secure profits/reduce losses of a trade, as such this tool can be useful to evaluate/determine user take profits/stop losses.

Due to these essentially being horizontal levels, they can also serve as potential support/resistances, with breakouts potentially confirming new trends.

Users might be interested in obtaining new targets once one is reached, this can be done by enabling "New Target When Reached" in the target logic setting section, resulting in more frequent targets.

Lastly, users can restrict new target creation until current ones are reached. This can result in fewer and longer-term targets, with a higher reach rate.

🔹Examples

The indicator can be applied to many overlay indicators that naturally produce crosses with the price, such as moving average, trailing stops, bands...etc.

Users can use trailing stops such as the SuperTrend or VStop to more easily create clean targets. Do note that certain SuperTrend scripts separate the upper and lower extremities of the SuperTrend into two different plot, which cannot be used with this tool, you may use the provided SuperTrend script below to have a compatible version with our tool:

Pine Script®

Using moving averages can produce more targets than other overlay indicators.

Users can apply the tool twice when using bands or any overlay indicator returning two outputs, using crossover targets for obtaining targets using the upper band as source and crossunder targets for targets using the lower band. We can also use the Trendlines with breaks indicator as example:

🔹Dashboard

A dashboard is displayed on the top right of the chart, displaying the amount, reach rate of targets 1/2, and total amount.

This dashboard can be useful to evaluate the selected target distances relative to the selected conditions, with a higher reach rate suggesting the distance of the targets from the price allows them to be reached.

🔶 SETTINGS

🔹Target

Crossover and Crossunder targets use the same settings below:

Alerts are included for the occurrence of a new target as well as for reached targets.

🔶 USAGE

In order for targets to be displayed users need to select an appropriate input source from the "Source" drop-down input setting. In the example above we apply the indicator to a volatility stop.

This can also easily be done by adding the "Targets For Overlay Indicators" script on the VStop indicator directly.

Targets can help users determine the price limit where the price might start deviating from an indication given by one or multiple indicators. In the context of trading, targets can help secure profits/reduce losses of a trade, as such this tool can be useful to evaluate/determine user take profits/stop losses.

Due to these essentially being horizontal levels, they can also serve as potential support/resistances, with breakouts potentially confirming new trends.

Users might be interested in obtaining new targets once one is reached, this can be done by enabling "New Target When Reached" in the target logic setting section, resulting in more frequent targets.

Lastly, users can restrict new target creation until current ones are reached. This can result in fewer and longer-term targets, with a higher reach rate.

🔹Examples

The indicator can be applied to many overlay indicators that naturally produce crosses with the price, such as moving average, trailing stops, bands...etc.

Users can use trailing stops such as the SuperTrend or VStop to more easily create clean targets. Do note that certain SuperTrend scripts separate the upper and lower extremities of the SuperTrend into two different plot, which cannot be used with this tool, you may use the provided SuperTrend script below to have a compatible version with our tool:

//@version=5

indicator("SuperTrend", overlay = true)

factor = input.float(3, 'Factor', minval = 0)

atrLen = input.int(10, 'ATR Length', minval = 1)

[spt, dir] = ta.supertrend(factor, atrLen)

plot(spt, 'SuperTrend', dir != dir[1] ? na : dir < 0 ? #089981 : #f23645, 2)

plot(spt, 'Circles', dir > dir[1] ? #f23645 : dir < dir[1] ? #089981 : na, 3, plot.style_circles)

Using moving averages can produce more targets than other overlay indicators.

Users can apply the tool twice when using bands or any overlay indicator returning two outputs, using crossover targets for obtaining targets using the upper band as source and crossunder targets for targets using the lower band. We can also use the Trendlines with breaks indicator as example:

🔹Dashboard

A dashboard is displayed on the top right of the chart, displaying the amount, reach rate of targets 1/2, and total amount.

This dashboard can be useful to evaluate the selected target distances relative to the selected conditions, with a higher reach rate suggesting the distance of the targets from the price allows them to be reached.

🔶 SETTINGS

- Source: Indicator source used to create targets. Targets are created when the closing price crosses the specified source.

- Show Target Labels: Display target labels on the chart.

- Candle Coloring: Apply candle coloring based on the most recent active target.

🔹Target

Crossover and Crossunder targets use the same settings below:

- Show Target: Determines if the target is displayed or not.

- Above Price Target: If selected, will create targets above the closing price.

- Wait Until Reached: When enabled will not create a new target until an existing one is reached.

- New Target When Reached: Will create a new target when an existing one is reached.

- Evaluate Wicks: Will use high/low prices to determine if a target is reached. Unselecting this setting will use the closing price.

- Target Distance From Price: Controls the distance of a target from the price. Can be determined in currencies/points, percentages, ATR multiples, or ticks.

Skrypt open-source

W zgodzie z duchem TradingView twórca tego skryptu udostępnił go jako open-source, aby użytkownicy mogli przejrzeć i zweryfikować jego działanie. Ukłony dla autora. Korzystanie jest bezpłatne, jednak ponowna publikacja kodu podlega naszym Zasadom serwisu.

Get exclusive indicators & AI trading strategies: luxalgo.com

Free 150k+ community: discord.gg/lux

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

Free 150k+ community: discord.gg/lux

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

Wyłączenie odpowiedzialności

Informacje i publikacje nie stanowią i nie powinny być traktowane jako porady finansowe, inwestycyjne, tradingowe ani jakiekolwiek inne rekomendacje dostarczane lub zatwierdzone przez TradingView. Więcej informacji znajduje się w Warunkach użytkowania.

Skrypt open-source

W zgodzie z duchem TradingView twórca tego skryptu udostępnił go jako open-source, aby użytkownicy mogli przejrzeć i zweryfikować jego działanie. Ukłony dla autora. Korzystanie jest bezpłatne, jednak ponowna publikacja kodu podlega naszym Zasadom serwisu.

Get exclusive indicators & AI trading strategies: luxalgo.com

Free 150k+ community: discord.gg/lux

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

Free 150k+ community: discord.gg/lux

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

Wyłączenie odpowiedzialności

Informacje i publikacje nie stanowią i nie powinny być traktowane jako porady finansowe, inwestycyjne, tradingowe ani jakiekolwiek inne rekomendacje dostarczane lub zatwierdzone przez TradingView. Więcej informacji znajduje się w Warunkach użytkowania.