OPEN-SOURCE SCRIPT

Zaktualizowano First Candle High Low Levels

Description

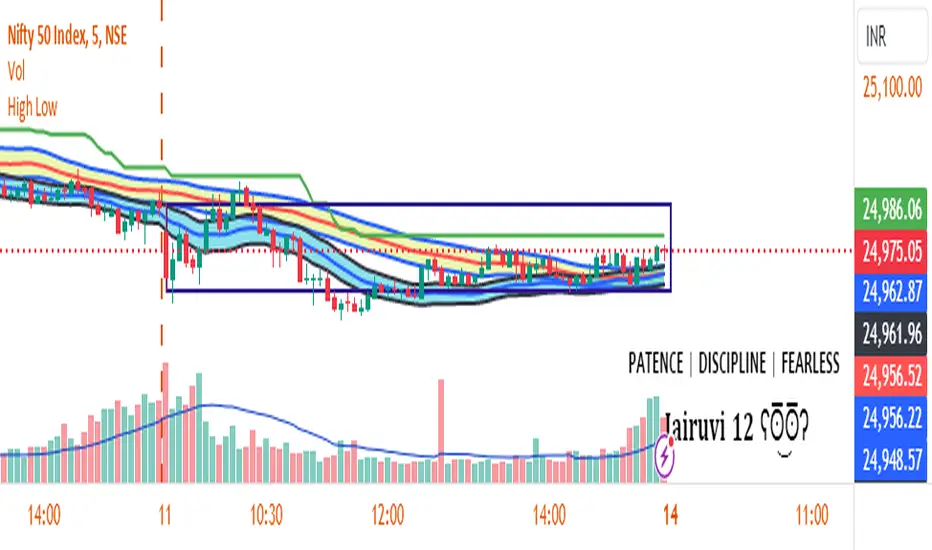

The "First Candle High Low Levels" Pine Script indicator is designed to highlight the high and low levels of the first candle of the day on your TradingView chart. It works across different timeframes and specifically handles the Indian stock market trading hours (9:15 AM to 3:30 PM IST). The script draws a box from the start to the end of the trading session, visually marking the price range defined by the first candle of the day. Traders can customize the box's border color, fill color, and line width.

Features

Usage

The "First Candle High Low Levels" Pine Script indicator is designed to highlight the high and low levels of the first candle of the day on your TradingView chart. It works across different timeframes and specifically handles the Indian stock market trading hours (9:15 AM to 3:30 PM IST). The script draws a box from the start to the end of the trading session, visually marking the price range defined by the first candle of the day. Traders can customize the box's border color, fill color, and line width.

Features

- Customizable Timeframe: Users can select the desired timeframe for the first candle (e.g., 5-minute, 15-minute, etc.).

- Custom Box Appearance: Options to adjust the border color, fill color, and line width of the drawn box.

- Auto Reset for Each New Day: The high and low of the first candle are reset daily to mark the start of the next trading day.

- Accurate Market Session Handling: The box is drawn from the start of the first candle to the end of the trading session (3:30 PM IST).

Usage

- Adding to Chart: Apply the script by copying it into the Pine Script editor in TradingView. Once added, the script will automatically draw a box representing the high and low of the first candle of the day.

- Select Timeframe: You can adjust the First Candle Timeframe input to define which timeframe candle will be used for marking the high and low. For example, if you choose a 5-minute timeframe, the high and low of the first 5-minute candle will be used.

- Customization:

- Adjust the Border Color and Box Fill Color through the input settings to match your chart's style.

- Modify the Box Line Width to make the box lines more or less prominent.

Informacje o Wersji

Sma Band (simple moving average channel)This TradingView indicator plots three Simple Moving Averages (SMAs) based on the high, close, and low prices over a customizable period. The upper band represents the SMA of the high prices, while the lower band represents the SMA of the low prices. Additionally, the area between these two bands is filled with a semi-transparent color, providing a clear visual of the price range over time. The middle band, based on the SMA of the closing prices, helps track the general trend.

This indicator is useful for traders who want to visualize potential support and resistance levels and identify price trends within a specific range.

Key Features:

- Customizable SMA Period: Set the period for the SMAs, allowing for fine-tuned analysis of price trends over different timeframes.

- Visual Band Creation: The indicator plots both upper and lower SMA bands based on high and low prices, offering a range view of market dynamics.

- Fill Color: A semi-transparent color fill highlights the range between the upper and lower SMA bands, making price action visually intuitive.

- SMA of Close Prices: Includes a central SMA based on the closing prices, helping to identify general price trends within the band.

- Toggle SMA Visibility: Option to show or hide the SMA bands and fill, providing a cleaner chart when needed.

- Visual Trend Analysis: Helps traders spot trends, consolidations, and potential breakout or reversal zones.

Informacje o Wersji

This script provides a robust combination of the Simple Moving Average (SMA) channel and the Supertrend indicator to enhance your trading strategy. The SMA channel consists of two bands—an upper and lower boundary—calculated by adding and subtracting a specific multiplier from the SMA. These bands help to visualize the range of price movements and identify potential breakouts or breakdowns around key price levels.The Supertrend indicator is layered on top of this channel, acting as a powerful trend-following tool that signals potential entry and exit points by shifting between bullish and bearish trends. It dynamically adjusts based on price movements and volatility, offering clear buy and sell signals.

By combining the SMA channel’s price range analysis with the Supertrend’s trend detection, this script offers traders a comprehensive view of market direction and volatility, helping to improve decision-making in various market conditions.

This combination works well for trend traders looking for a balance of dynamic price levels and reliable trend signals.

Informacje o Wersji

Also Update Zero Lag EMAThe Zero Lag EMA (Exponential Moving Average) Band is a technical indicator designed to reduce the lag inherent in traditional EMA calculations while maintaining the smoothing properties of the EMA. It aims to provide a more responsive signal by applying an additional calculation layer that attempts to eliminate the lag caused by the averaging process in standard EMAs. This makes it particularly useful for traders who want to detect trend changes or price movements more quickly than they could with standard EMAs.

The Zero Lag EMA Band typically consists of two lines, an upper and a lower band, that track price movements. These bands are calculated based on the Zero Lag EMA with an added offset or multiplier to create a range around the central moving average. The area between the upper and lower bands forms the “band” which can help identify periods of low volatility (when price stays within the band) or high volatility (when price moves outside the band). Additionally, traders use these bands to spot potential reversals, breakouts, and other significant price movements.

Overall, the Zero Lag EMA Band provides a dynamic and visually clear way to assess the strength and direction of market trends, and its faster response to price changes gives traders an edge in identifying entry and exit points with less delay compared to traditional EMA-based indicators.

Skrypt open-source

W zgodzie z duchem TradingView twórca tego skryptu udostępnił go jako open-source, aby użytkownicy mogli przejrzeć i zweryfikować jego działanie. Ukłony dla autora. Korzystanie jest bezpłatne, jednak ponowna publikacja kodu podlega naszym Zasadom serwisu.

Wyłączenie odpowiedzialności

Informacje i publikacje nie stanowią i nie powinny być traktowane jako porady finansowe, inwestycyjne, tradingowe ani jakiekolwiek inne rekomendacje dostarczane lub zatwierdzone przez TradingView. Więcej informacji znajduje się w Warunkach użytkowania.

Skrypt open-source

W zgodzie z duchem TradingView twórca tego skryptu udostępnił go jako open-source, aby użytkownicy mogli przejrzeć i zweryfikować jego działanie. Ukłony dla autora. Korzystanie jest bezpłatne, jednak ponowna publikacja kodu podlega naszym Zasadom serwisu.

Wyłączenie odpowiedzialności

Informacje i publikacje nie stanowią i nie powinny być traktowane jako porady finansowe, inwestycyjne, tradingowe ani jakiekolwiek inne rekomendacje dostarczane lub zatwierdzone przez TradingView. Więcej informacji znajduje się w Warunkach użytkowania.