OPEN-SOURCE SCRIPT

Zaktualizowano ATR RS 10/11

ATR RS — What it does (English)

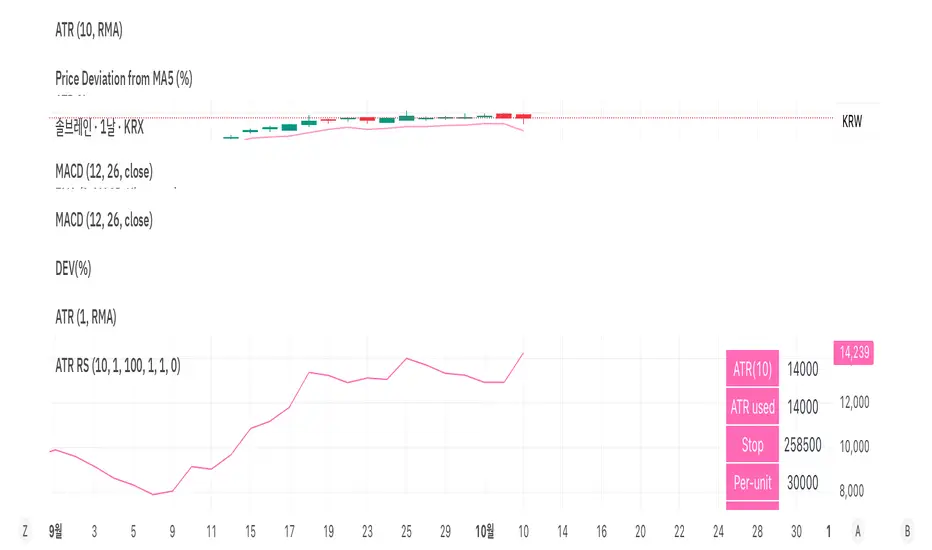

• Purpose: A compact risk-sizing helper that plots Daily ATR(10, RMA) in a separate panel and shows a live sizing summary (ATR used, Stop, Per-unit risk, Risk, Size, Bet). Works on any chart timeframe.

• Daily ATR logic (robust intraday handling):

– Before first trade of the session: use yesterday’s daily ATR only.

– During the session (daily candle unconfirmed): use max(today’s daily ATR, yesterday’s daily ATR) to avoid underestimating volatility early in the day.

– After the daily candle closes: use today’s daily ATR.

• Stop rule (long bias):

Stop = Today’s Daily Low − Multiplier × ATR_used

• Position sizing:

Per-unit risk = max(Entry − Stop, 0) × PointValue

Raw size = RiskAmount / Per-unit risk

Final size = floor(Raw size / LotSize) × LotSize

(Optional cap via Max Position Cap; negatives coerced to 0.)

• “Entry” price: current chart close (i.e., real-time last for intraday, or close for historical/confirmed bars).

• Panel fields:

– ATR(10): Daily ATR(10, RMA)

– ATR used: the volatility value selected by the intraday rule above

– Stop: computed stop price (you can snap to tick if desired)

– Per-unit: risk per share/contract = (Entry − Stop) × PointValue

– Risk: user input, account currency

– Size: position size after lot rounding and cap

– Bet: Entry × Size × PointValue

• Inputs:

– ATR Length (Daily RMA), Multiplier (for stop), Risk Amount, Point Value (stocks=1; futures=contract point value), Lot Size, Max Position Cap, Show summary table.

• Notes:

– Uses request.security(“D”, …) with no lookahead, so the same ATR is used consistently regardless of the chart timeframe.

– If your venue has fractional ticks, consider snapping the Stop to tick size so labels and price markers match perfectly.

• Purpose: A compact risk-sizing helper that plots Daily ATR(10, RMA) in a separate panel and shows a live sizing summary (ATR used, Stop, Per-unit risk, Risk, Size, Bet). Works on any chart timeframe.

• Daily ATR logic (robust intraday handling):

– Before first trade of the session: use yesterday’s daily ATR only.

– During the session (daily candle unconfirmed): use max(today’s daily ATR, yesterday’s daily ATR) to avoid underestimating volatility early in the day.

– After the daily candle closes: use today’s daily ATR.

• Stop rule (long bias):

Stop = Today’s Daily Low − Multiplier × ATR_used

• Position sizing:

Per-unit risk = max(Entry − Stop, 0) × PointValue

Raw size = RiskAmount / Per-unit risk

Final size = floor(Raw size / LotSize) × LotSize

(Optional cap via Max Position Cap; negatives coerced to 0.)

• “Entry” price: current chart close (i.e., real-time last for intraday, or close for historical/confirmed bars).

• Panel fields:

– ATR(10): Daily ATR(10, RMA)

– ATR used: the volatility value selected by the intraday rule above

– Stop: computed stop price (you can snap to tick if desired)

– Per-unit: risk per share/contract = (Entry − Stop) × PointValue

– Risk: user input, account currency

– Size: position size after lot rounding and cap

– Bet: Entry × Size × PointValue

• Inputs:

– ATR Length (Daily RMA), Multiplier (for stop), Risk Amount, Point Value (stocks=1; futures=contract point value), Lot Size, Max Position Cap, Show summary table.

• Notes:

– Uses request.security(“D”, …) with no lookahead, so the same ATR is used consistently regardless of the chart timeframe.

– If your venue has fractional ticks, consider snapping the Stop to tick size so labels and price markers match perfectly.

Informacje o Wersji

• What it doesCalculates a daily ATR(10, RMA) that is independent of your chart timeframe, then builds a simple risk‐sizing panel. It also shows an optional stop-price tag on the chart.

• ATR logic (intraday aware)

– Before the first trade of the day: use yesterday’s daily ATR.

– After the first trade, before the daily candle is confirmed: use max(today’s ATR, yesterday’s ATR).

– After the daily candle closes: use today’s ATR.

All numbers are snapped to the symbol’s tick size; for long setups the stop is floored to the nearest tick.

• Stop & risk

– Stop (long): Daily Low − Multiplier × ATR_used.

– Per-unit risk: max(Entry − Stop, 0) × PointValue, with Entry = current close.

– Position size: floor( RiskAmount / PerUnitRisk ) rounded down to your LotSize, and capped by MaxPosition (if set).

– Bet amount: Entry × Size × PointValue.

• Inputs

ATR Length, Multiplier, Risk Amount, Point Value (stocks=1, futures=contract point value), Lot Size, Max Position Cap, Show table, Show stop tag.

• Outputs

– Panel: ATR(10), ATR used, Stop, Per-unit, Risk, Size, Bet.

– Optional on-chart label showing the stop price (tick-snapped).

– Thin pink line in a separate pane plotting the daily ATR.

• Notes

If Per-unit risk is 0 or negative, size becomes 0 by design. For non-USD or futures, set PointValue accordingly to reflect P&L per price point.

Informacje o Wersji

ATR RS (Daily ATR) • What it does

Calculates a daily ATR(10, RMA) that is independent of your chart timeframe, then builds a simple risk‐sizing panel. It also shows an optional stop-price tag on the chart.

• ATR logic (intraday aware)

– Before the first trade of the day: use yesterday’s daily ATR.

– After the first trade, before the daily candle is confirmed: use max(today’s ATR, yesterday’s ATR).

– After the daily candle closes: use today’s ATR.

All numbers are snapped to the symbol’s tick size; for long setups the stop is floored to the nearest tick.

• Stop & risk

– Stop (long): Daily Low − Multiplier × ATR_used.

– Per-unit risk: max(Entry − Stop, 0) × PointValue, with Entry = current close.

– Position size: floor( RiskAmount / PerUnitRisk ) rounded down to your LotSize, and capped by MaxPosition (if set).

– Bet amount: Entry × Size × PointValue.

• Inputs

ATR Length, Multiplier, Risk Amount, Point Value (stocks=1, futures=contract point value), Lot Size, Max Position Cap, Show table, Show stop tag.

• Outputs

– Panel: ATR(10), ATR used, Stop, Per-unit, Risk, Size, Bet.

– Optional on-chart label showing the stop price (tick-snapped).

– Thin pink line in a separate pane plotting the daily ATR.

• Notes

If Per-unit risk is 0 or negative, size becomes 0 by design. For non-USD or futures, set PointValue accordingly to reflect P&L per price point.

Skrypt open-source

W duchu TradingView twórca tego skryptu udostępnił go jako open-source, aby traderzy mogli analizować i weryfikować jego funkcjonalność. Brawo dla autora! Możesz korzystać z niego za darmo, ale pamiętaj, że ponowna publikacja kodu podlega naszym Zasadom Społeczności.

Wyłączenie odpowiedzialności

Informacje i publikacje przygotowane przez TradingView lub jego użytkowników, prezentowane na tej stronie, nie stanowią rekomendacji ani porad handlowych, inwestycyjnych i finansowych i nie powinny być w ten sposób traktowane ani wykorzystywane. Więcej informacji na ten temat znajdziesz w naszym Regulaminie.

Skrypt open-source

W duchu TradingView twórca tego skryptu udostępnił go jako open-source, aby traderzy mogli analizować i weryfikować jego funkcjonalność. Brawo dla autora! Możesz korzystać z niego za darmo, ale pamiętaj, że ponowna publikacja kodu podlega naszym Zasadom Społeczności.

Wyłączenie odpowiedzialności

Informacje i publikacje przygotowane przez TradingView lub jego użytkowników, prezentowane na tej stronie, nie stanowią rekomendacji ani porad handlowych, inwestycyjnych i finansowych i nie powinny być w ten sposób traktowane ani wykorzystywane. Więcej informacji na ten temat znajdziesz w naszym Regulaminie.