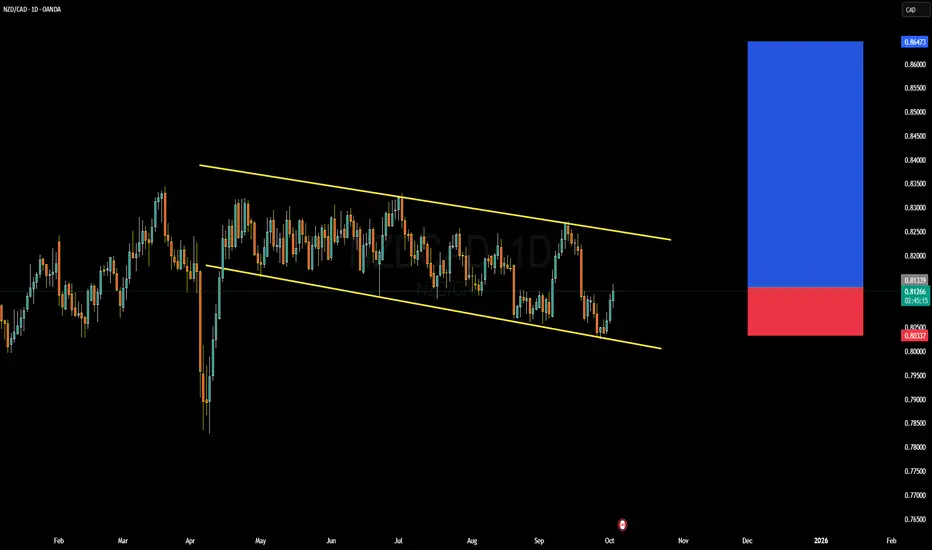

NZD/CAD is currently holding near a structural demand zone, after a sustained downtrend in recent months. Price has shown multiple rejections of lower levels, forming a potential accumulation base—this hints at a possible swing reversal if bulls step in with conviction. On the upside, the key pivot zone around 0.85-0.86 becomes resistance to watch for a breakout. If broken, price could target 0.860+ as the next clean supply area.

Fundamentally, both New Zealand and Canada are commodity exporters, which ties their currencies closely to global commodity trends. The NZD tends to benefit from softness in CAD when energy prices weaken, and vice versa. At present, global demand for oil is under pressure, which is a headwind for CAD. Meanwhile, New Zealand’s economy is exhibiting moderate resilience, and dairy export strength may lend supportive tailwinds to NZD. These dynamics slightly favor NZD in the cross.

With technical structure and macro tailwinds aligned, the risk/reward is better skewed toward a long entry from the demand zone, provided price holds and shows bullish confirmation (e.g. a strong reversal candle). I’d place stop below the recent swing low and scale into potential breakout above resistance. But if price breaks down decisively below the demand shelf, the bearish bias resumes and invalidates the bullish thesis.

Fundamentally, both New Zealand and Canada are commodity exporters, which ties their currencies closely to global commodity trends. The NZD tends to benefit from softness in CAD when energy prices weaken, and vice versa. At present, global demand for oil is under pressure, which is a headwind for CAD. Meanwhile, New Zealand’s economy is exhibiting moderate resilience, and dairy export strength may lend supportive tailwinds to NZD. These dynamics slightly favor NZD in the cross.

With technical structure and macro tailwinds aligned, the risk/reward is better skewed toward a long entry from the demand zone, provided price holds and shows bullish confirmation (e.g. a strong reversal candle). I’d place stop below the recent swing low and scale into potential breakout above resistance. But if price breaks down decisively below the demand shelf, the bearish bias resumes and invalidates the bullish thesis.

Join our Forex Community Telegram group and connect with thousands of traders.

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Wyłączenie odpowiedzialności

Informacje i publikacje przygotowane przez TradingView lub jego użytkowników, prezentowane na tej stronie, nie stanowią rekomendacji ani porad handlowych, inwestycyjnych i finansowych i nie powinny być w ten sposób traktowane ani wykorzystywane. Więcej informacji na ten temat znajdziesz w naszym Regulaminie.

Join our Forex Community Telegram group and connect with thousands of traders.

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Hit the Link below

👇👇👇

linkin.bio/andrewstelegramfamily

Wyłączenie odpowiedzialności

Informacje i publikacje przygotowane przez TradingView lub jego użytkowników, prezentowane na tej stronie, nie stanowią rekomendacji ani porad handlowych, inwestycyjnych i finansowych i nie powinny być w ten sposób traktowane ani wykorzystywane. Więcej informacji na ten temat znajdziesz w naszym Regulaminie.