Primary Elliott Wave Scenario –  NVO

NVO

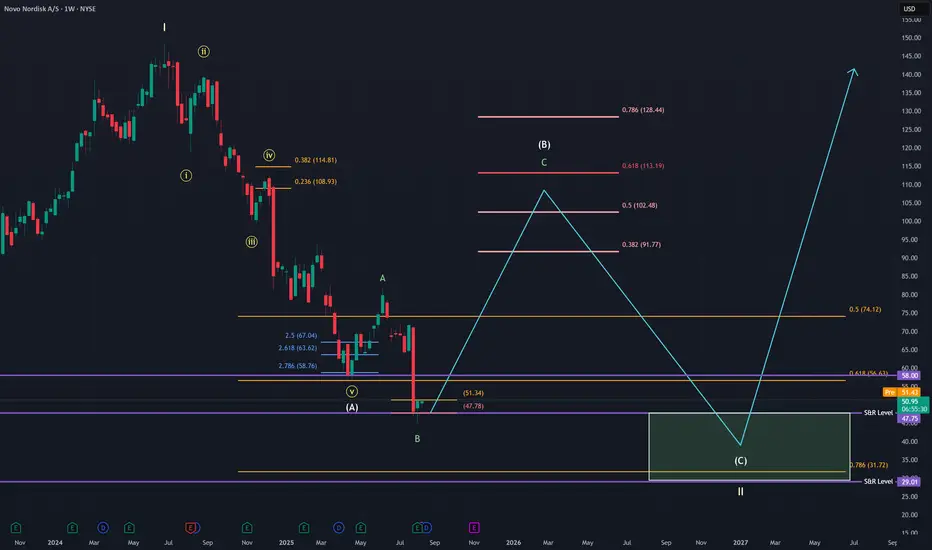

I believe NVO completed a multi-year Wave I in May 2024. Since then, we’ve seen the A-wave of a larger ABC correction play out.

NVO completed a multi-year Wave I in May 2024. Since then, we’ve seen the A-wave of a larger ABC correction play out.

The price dipped below the 0.618 Fib at $56.63, but reclaimed key support at $47.75. My current primary count suggests that the bottom might already be in.

The drop to $45 looks like an extended B-wave, hitting classic Fibonacci targets.

If the bottom is confirmed, I expect a B-wave rally with a likely target range of $91.77–$113.19 — possibly even higher.

This is not a short-term move; it will take time to develop.

After the B-wave completes, I anticipate a final C-wave down to $47.75–$29, which would complete the Wave II correction.

This would set up a major long-term buying opportunity for the years ahead.

Invalidation:

If price breaks below $45 again, this scenario is invalid. In that case, we likely head straight to $32 and the 0.786 Fib.

I believe

The price dipped below the 0.618 Fib at $56.63, but reclaimed key support at $47.75. My current primary count suggests that the bottom might already be in.

The drop to $45 looks like an extended B-wave, hitting classic Fibonacci targets.

If the bottom is confirmed, I expect a B-wave rally with a likely target range of $91.77–$113.19 — possibly even higher.

This is not a short-term move; it will take time to develop.

After the B-wave completes, I anticipate a final C-wave down to $47.75–$29, which would complete the Wave II correction.

This would set up a major long-term buying opportunity for the years ahead.

Invalidation:

If price breaks below $45 again, this scenario is invalid. In that case, we likely head straight to $32 and the 0.786 Fib.

Wyłączenie odpowiedzialności

Informacje i publikacje przygotowane przez TradingView lub jego użytkowników, prezentowane na tej stronie, nie stanowią rekomendacji ani porad handlowych, inwestycyjnych i finansowych i nie powinny być w ten sposób traktowane ani wykorzystywane. Więcej informacji na ten temat znajdziesz w naszym Regulaminie.

Wyłączenie odpowiedzialności

Informacje i publikacje przygotowane przez TradingView lub jego użytkowników, prezentowane na tej stronie, nie stanowią rekomendacji ani porad handlowych, inwestycyjnych i finansowych i nie powinny być w ten sposób traktowane ani wykorzystywane. Więcej informacji na ten temat znajdziesz w naszym Regulaminie.