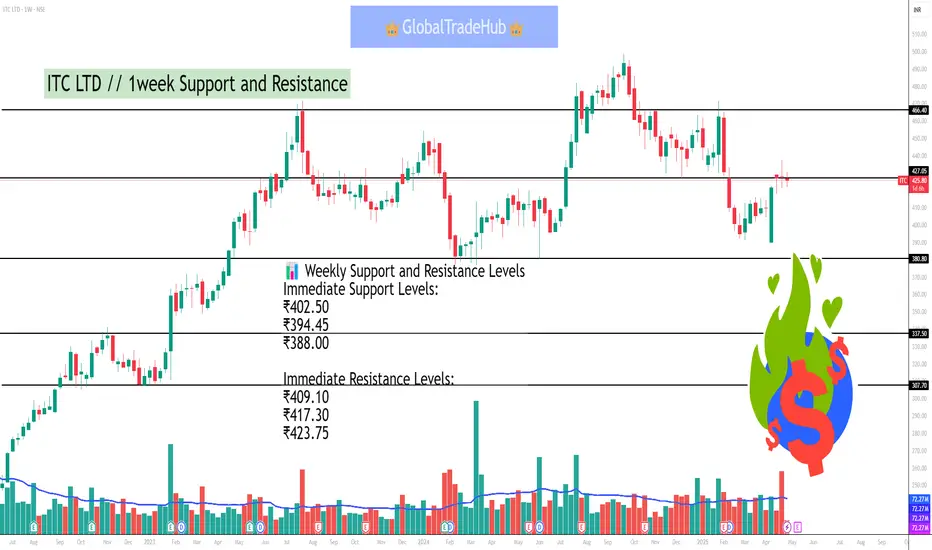

As of May 1, 2025, at 10:20 AM IST, ITC Ltd (NSE: ITC) is trading at ₹403.05. Based on recent technical analysis, here are the key support and resistance levels for the stock on a weekly (1W) chart:

📊 Weekly Support and Resistance Levels

Immediate Support Levels:

₹402.50

₹394.45

₹388.00

Immediate Resistance Levels:

₹409.10

₹417.30

₹423.75

These levels suggest that if the stock price declines below ₹402.50, it may find support around ₹394.45 and ₹388.00. Conversely, if the price rises above ₹409.10, it could encounter resistance near ₹417.30 and ₹423.75.

🔍 Technical Indicators

ADX (Average Directional Index): 29.19 – indicates a trending market.

RSI (Relative Strength Index): 47.4 – suggests neutral momentum.

MACD (Moving Average Convergence Divergence): -4.66 – indicates a negative trend.

CCI (Commodity Channel Index): 2.74 – suggests neutral momentum.

These indicators suggest a neutral to slightly bearish outlook for ITC in the short term.

📈 Summary

ITC is currently trading near its immediate support levels. A break below ₹402.50 could lead to a decline towards ₹394.45 and ₹388.00. On the upside, resistance is observed at ₹409.10, ₹417.30, and ₹423.75. Traders should monitor these levels closely, as a decisive move beyond these support or resistance levels could signal the next directional move.

📊 Weekly Support and Resistance Levels

Immediate Support Levels:

₹402.50

₹394.45

₹388.00

Immediate Resistance Levels:

₹409.10

₹417.30

₹423.75

These levels suggest that if the stock price declines below ₹402.50, it may find support around ₹394.45 and ₹388.00. Conversely, if the price rises above ₹409.10, it could encounter resistance near ₹417.30 and ₹423.75.

🔍 Technical Indicators

ADX (Average Directional Index): 29.19 – indicates a trending market.

RSI (Relative Strength Index): 47.4 – suggests neutral momentum.

MACD (Moving Average Convergence Divergence): -4.66 – indicates a negative trend.

CCI (Commodity Channel Index): 2.74 – suggests neutral momentum.

These indicators suggest a neutral to slightly bearish outlook for ITC in the short term.

📈 Summary

ITC is currently trading near its immediate support levels. A break below ₹402.50 could lead to a decline towards ₹394.45 and ₹388.00. On the upside, resistance is observed at ₹409.10, ₹417.30, and ₹423.75. Traders should monitor these levels closely, as a decisive move beyond these support or resistance levels could signal the next directional move.

Powiązane publikacje

Wyłączenie odpowiedzialności

Informacje i publikacje nie stanowią i nie powinny być traktowane jako porady finansowe, inwestycyjne, tradingowe ani jakiekolwiek inne rekomendacje dostarczane lub zatwierdzone przez TradingView. Więcej informacji znajduje się w Warunkach użytkowania.

Powiązane publikacje

Wyłączenie odpowiedzialności

Informacje i publikacje nie stanowią i nie powinny być traktowane jako porady finansowe, inwestycyjne, tradingowe ani jakiekolwiek inne rekomendacje dostarczane lub zatwierdzone przez TradingView. Więcej informacji znajduje się w Warunkach użytkowania.